Why join GCV Invest?

Offering private investors the potential to build a well balanced, growth-focused portfolio

We specialise in identifying alternative investment opportunities with high growth potential across three compelling asset classes: venture capital, private equity and property. This approach means we can not only help you build a well-diversified investment portfolio, but increase your exposure to some of the UK's best-performing alternative asset classes with the help of an experienced team and secure online investment portal.

Free to Join

We charge no upfront fees for being part of our investor network and providing access to our opportunities. Fees are only charged on profits from successful investments.

Unique Dealflow

The range and quality of our alternative investment opportunities are unmatched in the market. This allows our members to build a well-diversified investment portfolio.

Your Choice

The decision to invest in any individual opportunity is always entirely down to you. Build your portfolio your way to match your personal requirements and investment goals.

Flexible Investment

Our clients typically invest between £5,000 and £100,000 in each transaction. Investments vary depending on the asset class, personal investment objectives and risk profile.

Experienced Team

With decades of professional involvement in the alternative investment sector, our investment team provide you with access to their collective expertise, insights and networks.

Rigorous Analysis

We only invest in a small number of carefully selected opportunities each year. We combine extensive internal analysis with third-party due diligence to rigorously assess each opportunity.

Creating Value

After we invest, we support and monitor each investment opportunity throughout the investment lifecycle. We work closely with individual teams to drive the value creation strategy and realise healthy returns.

Client Support

Dedicated to providing unrivalled support. Our investment team is available to discuss your portfolio and investment preferences on a one-to-one basis by telephone, email, video conference or in person at our head office.

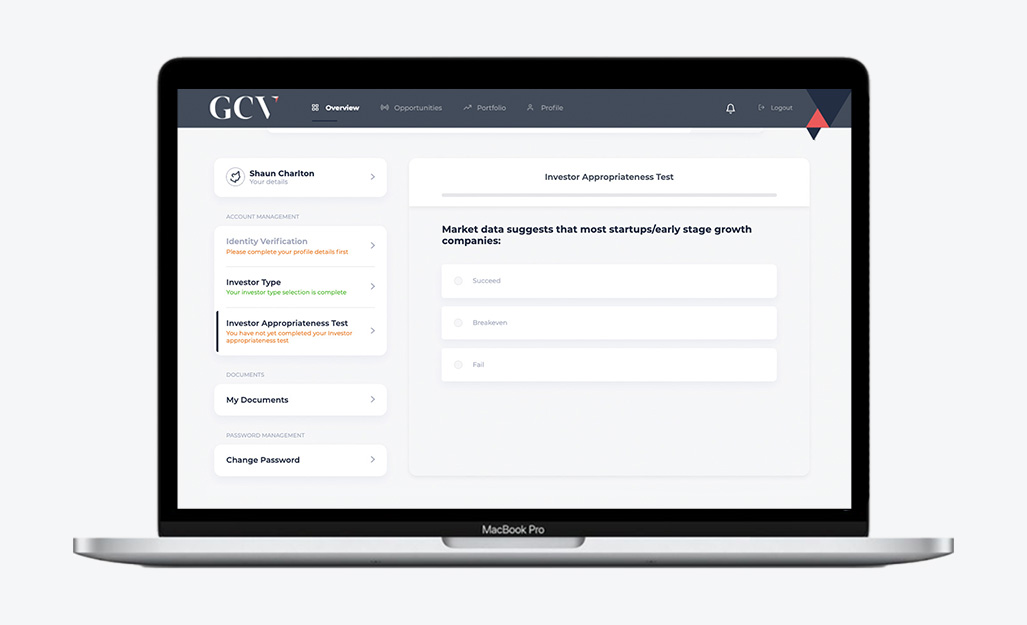

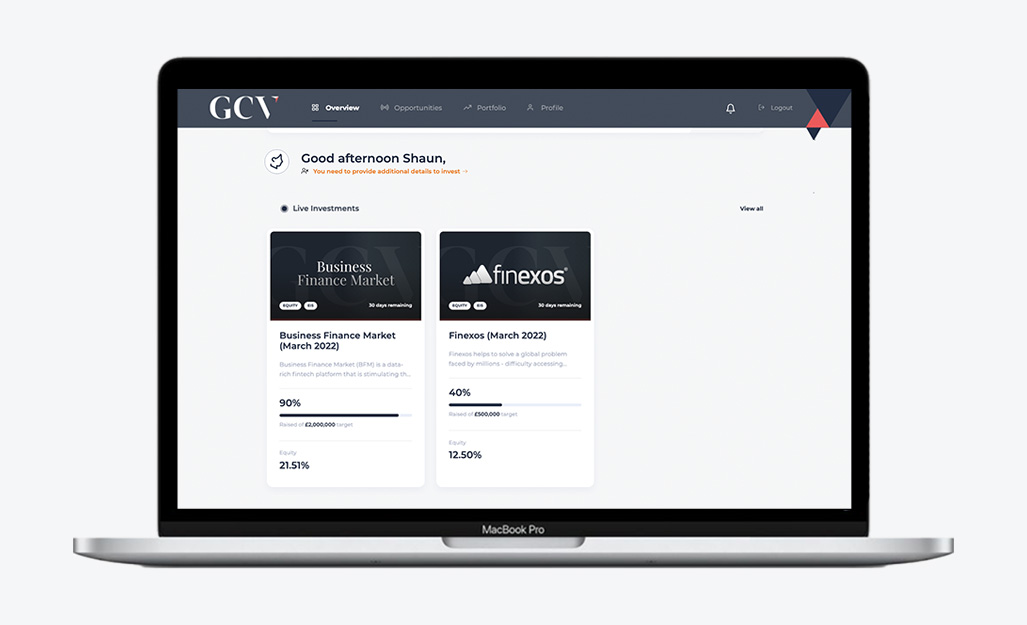

Secure Portal

Our secure online investment portal gives you full access to the latest investment opportunities. You can invest online and monitor the performance of your portfolio throughout the investment lifecycle.

%20(3)%20(2).jpg)

.jpg)

.jpg)

_099.jpg?width=3150&height=2100&name=Conviction%20(A)_099.jpg)