An introduction to property investing: 4 key concepts

As our regular readers will know by now, we are supporters of property investment and have produced a number of guides and webinars on the topic, as well as a large number of articles on our blog.

While we try to help you become familiar with all aspects of property investment, there are still a lot of terms we use when talking about property investing which may be unfamiliar unless you're investing regularly.

One such group of terms that we have used recently in our introduction to property investing webinar and guide to 'integrating property investments into your portfolio' is the concept of Core, Core+, Value Added and Opportunistic.

The basics

This group of terms are collectively used to describe the different investment strategies or styles that can be employed when investing into commercial property.

Each strategy takes a different approach to the risk/return profile, investment approach and management style. Therefore understanding these terms is important for investors to ensure they appreciate how their investment will be used, the risk they will be exposed to and what potential return is achievable.

These terms are most often used when considering indirect investment into commercial property through an investment structure such as a fund, Real Estate Investment Trust ('REIT') or other investment vehicles. In this case the investor invests their capital in the investment structure, which then holds the assets, making the investment into the property on behalf of the investors.

There is, therefore, a need to specify the nature of the property that will be invested into, both in terms of the risk/return profile and management style, which is provided at a glance by these terms.

As we have also been discussing a lot when we talk about property investment, there is the opportunity for either income or growth when investing into property. This is also a differentiating factor for these strategies, allowing investors to understand the return profile and timeline to expect from the investment.

The detail

Core

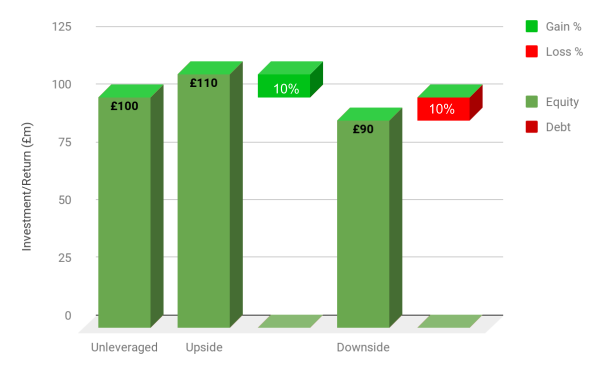

This is the most stable and lowest risk strategy. Core investments are usually high quality, relatively liquid assets, which provide an income. This income is generally backed by a strong track record and has a long forecast duration, providing a high level of security. Most often this investment is unleveraged, so has limited percentage downside risk while limiting the upside percentage gains available.

However, while providing secure and predictable income, there is very little scope for growth. Core property is usually already high quality or grade A property, with tenancies in place, therefore the scope for asset management to improve the value of the property.

An example of a core investment would be an office block which is already let to a large, established organisation, with a long term lease and upwards only rent reviews. This would provide a long term, predictable rental income with high security.

Core Plus

Core plus, as the name suggests, is broadly similar to Core but with additional scope for growth. While still focused on income, this will potentially be of a lower quality, or with a higher level of available capacity. This means there is scope for asset management, whereby the property can be improved and contracts can be negotiated to better terms increasing the value of the property.

This can bring with it the potential for a higher rate of return in total, once the income is taken into account and any growth achieved. However, with this increased potential return and scope for growth there will be a less predictable, possibly lower, income and a higher level of associated risk involved.

Value Add

Some sources will refer to Core and Value Add interchangeably and will only refer to the three styles of investment strategy. However, Value Add will most often be more focused on adding additional value to a property with some income, whereas Core plus is essentially Core will some potential for adding value. These are therefore better thought of as contrasting strategies.

Value Add will seek to invest in properties where there is a higher scope for improving the assets through renovation or redevelopment, but a limited amount of income already in place. This has a slightly higher risk profile than Core Plus, as there is a lower level of income already in place - but the potential for return is also slightly higher, as the value of the whole property can be improved and then let out for an income, as well as adding to the scope for return.

For example, this could be a lower grade office block that has a reduced occupancy, which could be bought and renovated. This would allow the office to increase the rental rate, bringing an income in the short term and once near capacity can be sold on as a Core or Core Plus investment to realise the growth.

Both Core Plus and Value Add can be seen as occupying the middle ground between growth potential and predictable income. They therefore also both occupy the middle of the risk/return profile, though in a slightly different way. To help offset this risk, leverage might be used to limit the maximum amount of capital at risk, though increasing the percentage risk and return potential on the investment.

Opportunistic

This final approach is the highest risk approach to commercial property investment, but there is also high potential for return through growth. This approach seeks to achieve a return by making use of the cyclical nature of the property market by buying into investments when there is little demand and holding them to realise a return when the market turns in favour of the investors. This approach is therefore seen as less liquid, due to the need to hold the investment through the period of low demand.

This approach has very little scope for income, as there will be little to no tenancy and no duration remaining for future income. This investment seeks to make all of its return through growth, be that through redevelopment or refurbishment of an unoccupied office block or the development of a new block entirely.

To help in offsetting this higher risk, these developments are usually highly leveraged, limiting the maximum amount at risk. Investors therefore need to provide only part of the total capital, meaning that as a percentage of invested capital the returns are much higher (but likewise the percentage lost on the downside is higher).

Understanding your needs as a property investor

As with all property investments, you should understand your requirements and understand the risks of the investment approach. Professional advice should always be sought before you invest into any opportunity to ensure it is correct for you.

As you can see, whatever your personal risk appetite and approach to investment, there is a way to invest into commercial property and provide you with a potential return. This could be as as stable income or as a lump sum via high level growth to repay patience. Exactly the same as with residential property, there is an investment approach that can bring a return to fit your needs.

%20(3)%20(2).jpg)