Open fast find

Close fast find

EIS deferral relief: how can you benefit as an investor?

The Enterprise Investment Scheme (EIS) is a UK venture capital scheme renowned for the generous tax reliefs it offers investors when investing in early-stage companies.

One of the lesser known but most advantageous of these reliefs is EIS deferral relief. Also known as capital gains tax (CGT) deferral relief, it can enable investors to defer the payment of an existing CGT bill up to £2 million to a later year.

As a result, ensuring investors are aware of the numerous rules surrounding this relief can be crucial to reaping its rewards.

1. What is EIS deferral relief?

EIS deferral relief is one of the main tax incentives offered by the Enterprise Investment Scheme. It can enable investors to defer the payment of an existing capital gains tax bill to a later year, should the gain be reinvested into EIS-eligible shares.

This means investors can treat gains acquired from shares, property, or any other chargeable asset as though they had been acquired in future years. As a result, this can enable investors to reorganise personal tax liabilities optimally and make the best use of annual tax allowances.

The maximum an individual can invest in the EIS per tax year is £1 million (rising to £2 million providing all capital over £1 million is invested into knowledge-intensive companies [KICs]). In turn, this is the maximum value of a gain that can be deferred via EIS deferral relief.

2. How does EIS deferral relief work?

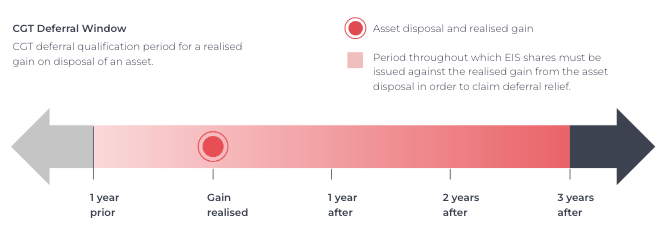

To qualify for CGT deferral relief, the sum of an individual's gain must be reinvested into EIS-qualifying shares between one year prior and up to three years after the gain is realised.

This not only means that an investor can defer a CGT bill via this relief several years after it arises, but can also invest via the EIS anticipating a CGT bill the next tax year.

For example: an additional rate taxpayer sells a property and makes a capital gain of £100,000 on 10th September 2024. Where £27,200 would usually be deducted from this gain in CGT, EIS deferral relief will allow them to retain the full gain should it be invested into EIS shares issued between 10th September 2023 and 10th September 2027.

This gain will cease to be deferred once the EIS shares are sold. However, if (following EIS share sale) the process is repeated and the original gain is reinvested, the CGT liability can continue to be deferred. If this process continues to be repeated, the CGT bill can be deferred indefinitely.

3. Who is eligible for EIS deferral relief?

To invest via the EIS, it is not a requirement for individuals to be UK-based. However, to be eligible for EIS deferral relief investors must fulfil several criteria:

- UK residency: though UK residency is not required to invest via the EIS, it is a requisite to claim CGT deferral relief.

- Not an employee: investors who are employed by the company distributing shares are not eligible to claim CGT deferral relief.

- Sufficient capital gains tax liabilities: the investor must have accrued or plan to accrue a CGT bill within the eligible timeline outlined in the previous section, in order to then defer it.

- Minimum holding period: the investor must hold the EIS shares for at least three years. If EIS shares are sold before this period, the deferral relief will be void.

Access: Free Guide to the Enterprise Investment Scheme

4. Can you push back any CGT bill using EIS deferral relief?

Providing you purchase shares in an EIS-eligible company and follow investor requirements and limits, you can defer the CGT bill due from any chargeable asset.

A chargeable asset is any asset that would give rise to a capital gains tax bill when disposed of. Among other examples, these include listed equities, property (other than a primary residence) and personal possessions (that exceed £6,000 per item).

The below table shows the varying rates of capital gains tax that would normally be due following the sale of assets. These vary depending on asset type and income tax band.

|

Tax Bracket |

Income range |

CGT rate on assets |

CGT rate on property |

|

Basic rate taxpayer |

£12,571 to £50,270 |

10% |

18% |

|

Higher rate taxpayer |

£50,271 to £125,140 |

20% |

28% |

|

Additional rate taxpayer |

Over £125,140 |

20% |

28% |

5. What are the benefits associated with EIS deferral relief?

As one of the most flexible EIS tax reliefs, EIS deferral relief can offer investors a number of core advantages:

- Flexible tax planning: EIS deferral relief can enable investors to defer the payment of CGT due on an asset to a later year. This can enable investors to plan their CGT liabilities in a way that is optimal for their tax circumstances.

- Avoidance of CGT: if an investor reinvests the value of their original gain again once EIS shares have been sold, their CGT liability will continue to be deferred. If this process is repeated, CGT bills can be deferred indefinitely until the point of the investor’s passing. At this point, the CGT liability will be terminated.

- Maximisation of tax allowances: the annual capital gains tax allowance in the UK is decreasing. In the 2024/25 tax year, it is set to halve for the second consecutive year to £3,000. By deferring CGT liabilities, investors can ensure their CGT allowance is freed up for gains elsewhere.

- Broad applicability: investors can defer gains from the sale of any chargeable asset. Including shares, property, cryptocurrency, personal possessions and otherwise, this can make deferral advantageous to a broad range of investors, regardless of venture capital experience.

Access: Free Guide to Reducing Capital Gains Tax

6. Are there any risks associated with EIS deferral relief?

Whilst CGT deferral can pose several advantages to experienced investors and high earners in particular, individuals should be aware of its potential risks:

- Changes to UK residency: should the investor cease to be a UK resident within three years of investment, their gain will cease to be deferred. This can be mitigated by ensuring the investor plans to maintain their residency prior to investing.

- Changes to EIS eligibility: should the company cease to be EIS-qualifying within three years of investment, the gain will cease to be deferred. Three-year EIS-eligibility is generally agreed across most opportunities. However, this risk can be mitigated by confirming this with the investment provider.

- Regulatory changes: the rules surrounding EIS reliefs can be subject to changes by the Government. There have been no impeding changes to the EIS since its introduction in 1996. Additionally, none are currently forecasted. However, it is still important for investors to bear this caveat in mind.

7. How can I claim EIS deferral relief?

Once the investment provider issues shares to the investor, they will distribute EIS3 certificates to each investor to certify the EIS-eligibility of the investment.

To claim EIS deferral relief, investors can complete the claim form attached to their EIS3 certificate. Once they have done so, they should attach this to the capital gains summary page of their annual tax return before submitting it to HMRC.

Alternatively – for investors who don’t complete regular self-assessment tax returns – CGT deferral relief can be claimed by completing an HMRC online self-assessment form. On this form, they can state their wish to defer a gain via deferral relief.

Investors can file this claim up to five years from the 31st January after the date EIS shares were issued.

8. What other tax advantages does the EIS offer?

CGT deferral is one of several tax advantages offered by the Enterprise Investment Scheme.

Combining to minimise investment risk, maximise potential returns and assist with tax planning, the full range of EIS tax reliefs are listed in the table below.

|

EIS Tax Incentive |

Benefit |

|

Effective investor spend of 70p in the £1 |

|

|

Zero CGT to pay when shares are realised (usually 20%) |

|

|

Capital gains tax deferral |

Ability to defer the payment of an existing CGT bill to later years |

|

Zero IHT to pay on shares upon passing (usually 40%) |

|

|

Offset any potential losses by rate of income tax or CGT |

9. Accessing the most appropriate EIS investment

Whilst deferral relief is a particularly powerful advantage of the EIS, investors should be aware of the scheme's full range of features to make the most appropriate investment decision.

Offering a range of tax reliefs, impact benefits and diversification advantages across a breadth of industries, EIS investments can suit varying investor demands.

In turn, ensuring individuals conduct thorough research into the EIS and/or receive professional tax guidance prior to investing can prove crucial to the success of an investment.

To assist with this, we have created a comprehensive investor guide to the Enterprise Investment Scheme. In this guide, we offer an end-to-end overview of the EIS, its reliefs, risks, routes to access and more. You can access the guide for free below.

%20(3)%20(2).jpg)