Alyssa Peterson

· 4 min read

· Updated on

Open fast find

Close fast find

Easy Find

UK Bank Rate reaches highest level in 15 yearsUK recession outlook: milder than previously anticipated?Eurozone economy: markets forecast ECB to raise interest rates to an all-time highRecord capital gains tax revenue collected in the UKVenture capital: global investment report 2023 – an insight from Preqin Private equity: UK investment activity in 2022 – a roundup from BeauhurstAverage UK house price stagnates after four months of declineA closing noteFinance & investment recap: rising Bank Rate, record VC and a settling housing market

From UK tax revenues reaching record levels to interest rates being raised for the tenth consecutive time, this roundup highlights key economic data for our investor network to digest as we head into March 2023.

UK Bank Rate reaches highest level in 15 years

- The Bank of England (BoE) raised the UK Bank Rate for the tenth consecutive time on February 2nd 2023

- This single rise of 0.5 percentage points caused the Bank Rate to reach 4.0%, the highest rate in 15 years

- In comparison, the BoE Bank Rate stood at just 0.1% in December 2021

- Financial markets believe that the BoE has already issued the majority of the monetary tightening required in this cycle

- Markets are pricing a peak in UK interest rates of approximately 4.5%, which is fairly moderate compared to the 6.0% interest rate peak previously anticipated in September

- The UK Consumer Price Index (CPI) was recorded at 10.1% in January 2023 – over five times above the BoE’s target of 2%

- However, this figure is likely to fall sharply over the next 18 months as wholesale gas prices have fallen recently and global supply chain disruption appears to have eased amid slowing global demand

UK recession outlook: milder than previously anticipated?

- The UK recession forecast for 2023 is expected to be milder than previously anticipated, with Ernst Young expecting RGDP growth to contract by 0.7% this year

- Furthermore, Deloitte is forecasting a 0.8% contraction of UK RGDP growth in 2023, an upwards revision from the previous forecast of a 1.4% contraction

- Improved news regarding energy supply, inflation and the outlook for the economies of China, the US and the EU lie behind this upgrade

- The UK narrowly avoided recession at the end of last year as the economy stagnated in the final quarter of 2022, recording GDP growth of 0.0%

- This stagnation was partly due to a rise in business investment and consumer spending being offset by poor export value

Eurozone economy: markets forecast ECB to raise interest rates to an all-time high

- The European Central Bank (ECB) is expected to raise interest rates to all-time high, spurred on by the eurozone economy’s resilience and signs that inflation could prove tougher to rein in than expected

- Markets have revised forecasts of interest rates upwards after recent eurozone data on buoyant service-sector activity and wage demands

- Swap markets are pricing in a jump in the ECB’s deposit rate to 3.75% by September, up from the current 2.5%

- This would match the benchmark’s 2001 peak, when the ECB was still trying to shore up the value of the newly launched euro

Record capital gains tax revenue collected in the UK

- Capital Gains Tax (CGT) receipts of £13.2 billion were recorded in the UK in January 2023, the highest figure on record, revealing a 24% YoY increase

- This rise in CGT revenue is likely to be fuelled by investors locking in their capital gains ahead of rules tightening in April 2023

- Typically, CGT receipts peak in the first three months of the year, but this is the most significant peak yet recorded

- Furthermore, total inheritance tax (IHT) receipts for April 2022 to Jan 2023 reached £5.8 billion, 15% higher than the same period a year previously

- IHT receipts are on an upwards trend, on track to break last year’s record of £6.1 billion by more than 10%

- The Office for Budget Responsibility (OBR) forecasted last year that UK IHT receipts would keep growing to reach £7.8 billion in the 2027/28 tax year

Venture capital: global investment report 2023 – an insight from Preqin

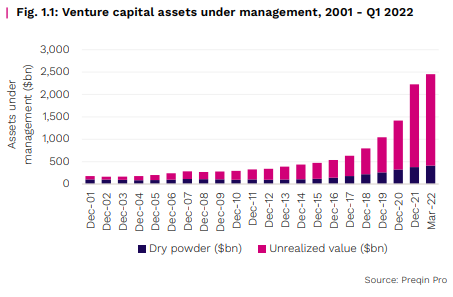

- The value of the global venture capital market has nearly quadrupled from the end of 2017 to March 2022, reaching $2.45 trillion

- The asset class tripled in AUM, from approximately $550 billion to $1.46 trillion over the past five years

- Furthermore, VC AUM are expected to rise again to just over $4.17 trillion by 2027

- Venture capital has been the strongest driver of private capital returns over the past decade

- The asset class has delivered a median net IRR of 22.7%, outperforming private equity (19.2%) at a marginally higher level of risk

- $73.4 billion was fundraised by early-stage strategies globally in 2022, higher than any other venture capital strategy

- IT continued to dominate deals in Europe, especially the software subsector, which counted 4,348 deals, more than three times as many deals as any other subsector

- The median IT deal value continued to increase across most financing stages, with the seed median deal value increasing 66.7% YoY, the early stage 35.9%, and the late stage 27.4%

Private equity: UK investment activity in 2022 – a roundup from Beauhurst

- Q1 2022 remains the top-performing quarter in the UK to date for private market investments, but it was a year of two halves

- Overall, private investment activity did decline from 2021, with £19.7 billion invested into private UK companies during 2022 across 2,722 announced equity rounds

- The seed stage was the only stage of development to see an increase in deal numbers since 2021, despite a 13% drop in first-time fundraisings

- It is unsurprising to see that the stage of company that fared best in 2022 was the seed stage, as the riskiest part of private equity investment is also the most countercyclical

Average UK house price stagnates after four months of decline

- UK house prices were unchanged from December 2022 to January 2023 following four months of decline, according to the Halifax House Price Index

- The index is calculated from Halifax’s own database of approximately 300,000 mortgage approvals, and the average UK house price as of January 2023 was calculated as £281,684

![]()

A closing note

In 2022, the UK went through three Prime Ministers and four Chancellors of the Exchequer, the pound sterling fell to an all-time low against the US dollar, the Bank of England increased interest rates eight times, and inflation spiralled to a 40-year high. Despite this, private investment markets were still able to deliver significant returns for investors, and the overall outlook for UK economic growth in 2023 has already been revised upwards.

%20(3)%20(2).jpg)