Growth of the peer-to-peer asset class

Interest rates really do matter to people. They directly affect the affordability of their mortgage and the return offered on their savings. Most people have – to a greater or lesser degree – an interest in both financial products.

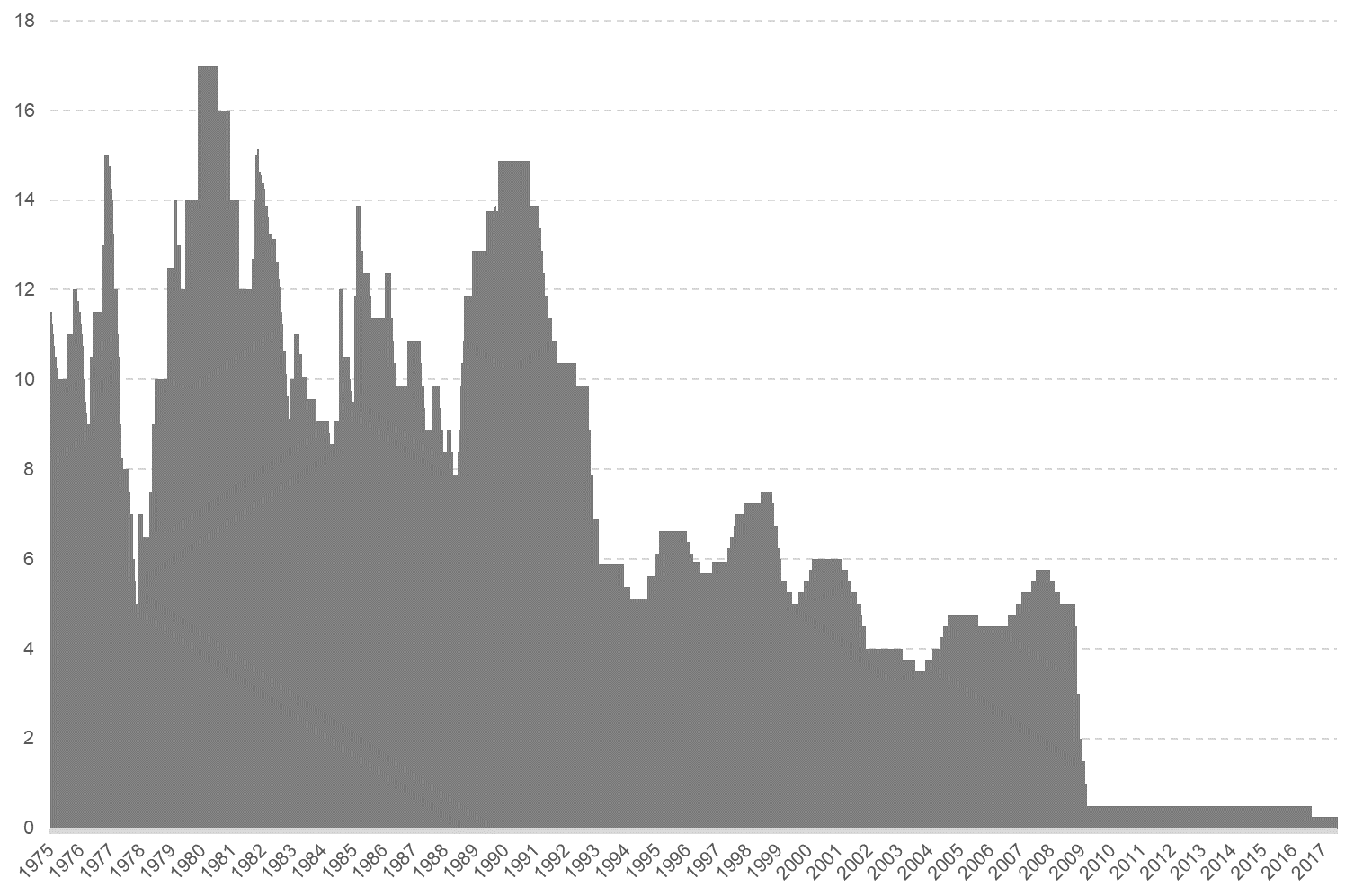

The chart below intentionally has no titles, but the eagle-eyed amongst us will be able to have a decent guess at what it represents.

However, persistently low interest rates present as many policy challenges as solutions. From an individual perspective, savers are facing difficulties maintaining the real terms value of their asset. Earlier in 2017, Royal London highlighted the scale of this in its powerful policy paper The Curse of Long-Term Cash. Royal London contrasts the value of a £1,000 investment made ten years ago. In a Cash ISA, this would now be worth less than £900; in a multi-asset fund, this would now be worth an estimated £1,500. Royal London concludes that the UK Government should do more to discourage people from using Cash ISAs as long-term investment vehicles.

Moving away from savings

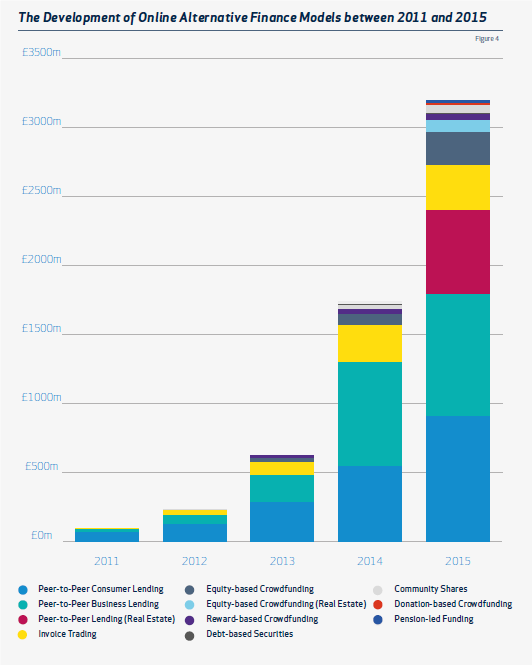

Perhaps inevitably, limited returns on cash balances are driving people away from saving. Many have found a natural home in the world of peer-to-peer (P2P) lending. Central to the P2P proposition has been an ability to shift the lending asset class away from institutions and towards individuals. Where as banks previously dominated lending to individuals and businesses, P2P platforms enabled individuals to lend directly. This disruptive technology has realised operational efficiencies such that it can offer superior rates (to both borrowers and lenders) whilst maintaining sufficient rigour that it commands the confidence of both groups.

Almost £1.5bn was lent to UK businesses through P2P platforms in 2015 alongside over £0.9bn to UK consumers. This represented average annual growth rates of 194% (lending to businesses) and 78% (lending to consumers) between 2013-2015, respectively.

“Peer-to-peer lending is not saving – it’s somewhere in between saving and investing." Martin Lewis captures the essence of P2P lending. It suits people who have capital on which they are seeking a return, but who find the prospect of equity investment too risky. The perceived risks could be around loss of value (although lending carries the risk of default) or around loss of liquidity. Lending has a fixed point at which the loan is scheduled to have been repaid. Although some equity investments are more tradable than others, it might not be possible to immediately liquidise even the most tradable equity investment.

Future outlook

Leading P2P lending platforms have been around for over ten years, but continue to evolve. Most recently, established providers have sought and secured banking licences that will enable them to offer additional financial products, such as Innovative Finance ISAs. This reinforces the supposition that P2P platforms are moving into the mainstream and seeking to emulate the model that they initially disrupted. This accreditation reinforces the legitimacy of P2P lending platforms and should go some way to addressing concerns expressed in 2016 by a former regulator.

The characteristics that made P2P platforms an appealing proposition for investors are likely to endure for as long as low interest rates offer savers such limited returns. Factors such as increased technological capability and trust in innovative financial institutions have also assisted the development of the P2P sector. Reflecting on the notion that P2P lending sits between saving and investing, it seems entirely logical that a P2P lending platform could represent a perfect complement to an equity co-investment platform.

%20(3)%20(2).jpg)