How to claim SEIS tax reliefs: everything you need to know

Having raised more than £2 billion for over 22,000 UK startups within a decade of launching, the Seed Enterprise Investment Scheme (SEIS) has become synonymous with the British startup scene in recent years, in part being down to the host of especially generous tax reliefs it offers private investors. SEIS plays a key role in providing funding for early-stage companies, while also complementing other venture capital schemes available in the market.

Offering advantages including everything from 50% income tax relief to capital gains tax exemption to loss relief, the SEIS has made a name for itself as a truly tax-efficient investing tool, but how exactly can investors go about claiming SEIS tax relief?

Claiming SEIS Income Tax Relief

SEIS income tax relief offers investors a 50% reduction in their income tax liability based on the amount invested. This relief can substantially reduce your overall tax bill. To claim this relief, you’ll need your SEIS3 certificate, which details your investment and the share issuance date. Whether you complete your claim via a paper or online Self-assessment tax return—or even through an adjustment to your PAYE tax code—the SEIS3 certificate is essential.

If you miss the initial tax year, you can often carry the relief back to the previous year (subject to HMRC’s deadlines). In addition, many investors opt for SEIS loss relief options which can protect them by offsetting any effective loss against other taxable income. You can calculate this relief as well as the others mentioned using the SEIS tax relief calculator.

Claiming SEIS Capital Gains Tax Reliefs

SEIS investments can also bring significant benefits when it comes to Capital Gains Tax (CGT) in the form of SEIS reinvestment relief & CGT Exemption.

SEIS reinvestment relief

By reinvesting gains into SEIS shares, you may reduce your capital gains tax liability. It allows an individual who has disposed of a chargeable asset - that would normally be liable to capital gains tax (CGT) - to treat up to 50% of the gain as capital gains tax exempt should they reinvest some or all of it into SEIS qualifying shares. It can be claimed via the self-assessment form after receiving your SEIS3 form. Complete the SEIS3 claim form from the company you invested in and attach it to the Capital Gains Tax summary pages of your tax return. Enter the code ‘OTH’ in box 28 on page CG 2 and provide claim details in box 54 or your computation, stating you’re claiming SEIS reinvestment relief.

In box 40, enter the total exempt gains (up to £50,000) from asset disposals reinvested into SEIS shares by 5 April 2024. If claiming after submitting your tax return, send the SEIS3 form to HMRC.

CGT exemption

Additionally, if you hold your SEIS shares for the required period (typically three years), any profit on disposal may be fully exempt from CGT. This exemption encourages long-term investment in early-stage companies, reducing your tax burden upon exit. If market conditions change, investors may even face losses, which can be partly offset by available reliefs.

While SEIS shares are automatically exempt, it may still be useful to note this in the Other information section of the Capital Gains Tax summary in your self-assessment.

Claiming inheritance tax relief

Under specific conditions, SEIS investments can qualify for Inheritance Tax (IHT) relief. If the investment meets HMRC’s criteria and is held for the necessary period, it may be disregarded for IHT purposes, reducing the overall value of your estate for tax purposes. As with other reliefs, keeping your SEIS3 certificates and adhering to the required holding periods is crucial. This aspect of SEIS makes it especially attractive as a long-term funding tool for startups, while also benefiting investors planning their estate.

What you'll need to have ready

Before initiating any claim, ensure you have your key document—the SEIS3 certificate. This certificate, issued by the company in which you’ve invested, contains vital details about your investment and is typically received around three months after the investment round closes. Note that:

- When investing directly into a company via SEIS, you receive one SEIS3 certificate.

- When investing through a fund or a venture capital scheme (such as a venture capital trust), expect an SEIS3 form for each underlying company.

- Occasionally, an advance assurance from HMRC may also be provided, offering additional comfort before you commit.

The SEIS3 certificate includes:

- The full company name

- The amount invested (upon which your tax relief is calculated)

- The share issuance date

- The relevant HMRC office and its reference

How to claim SEIS income tax reliefs in practice

How to claim SEIS tax reliefs via a paper-based self-assessment tax return

Claiming SEIS tax relief on a paper tax return is a quick and simple process, requiring only three initial steps:

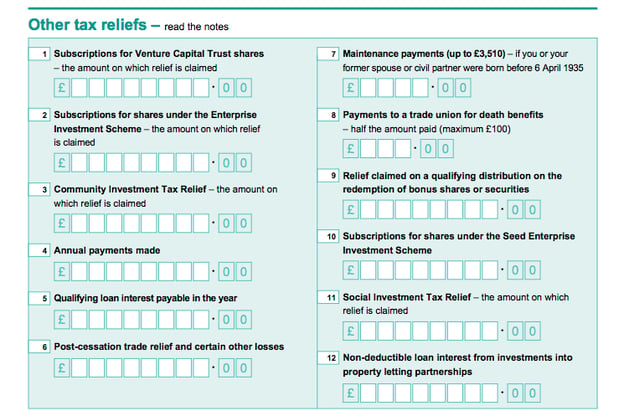

- Print off the ‘Additional information’ self-assessment sheet (SA101) found on the gov.uk website, which you can access here.

- On page two of the form, under the heading titled ‘Other tax reliefs’ and under box 10 titled ‘Subscriptions for shares under the Seed Enterprise Investment Scheme’, detail the combined total of all of your SEIS investments of which you would like to claim tax relief on.

- Continue to fill and file your paper tax return as usual and post to the relevant HMRC office once completed.

If claiming SEIS relief via a paper-based self-assessment tax return, no proof of your SEIS3 certificate is necessary to complete the process. However, it is important to keep a record of all of your SEIS3 certificates and any other COBs (certificates of beneficial ownership) as you may be requested to provide them as evidence of your investment at a later date.

Claiming SEIS relief via an online self-assessment tax return

Claiming SEIS tax relief online is as straightforward as on a paper-based return, again following three simple steps to make your submission:

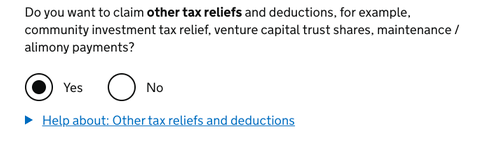

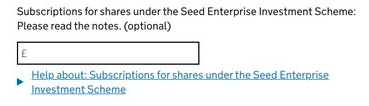

- Navigate to section three of the return, titled ‘Tailor your return’ and select ‘Yes’ under the question regarding ‘other tax reliefs’.

- On page two – ‘Other tax relief and deductions’ – scroll to the box titled ‘Subscription shares under the Seed Enterprise Investment Scheme’ and enter the combined value of all of your SEIS investments that you wish to claim tax relief on, also providing the relevant details of said investments when asked.

- Fill out the rest of your tax return accordingly and submit it.

Claiming SEIS relief by submitting your SEIS3 certificate

Though claiming SEIS tax relief via a paper return and through an online self-assessment form are the two most common ways investors usually opt for, there are additional options that can also be considered in certain circumstances.

The most common of the alternatives is by using the SEIS3 form itself. By completing pages three and four of your SEIS3 form once received, you can post it to your HMRC office for the process to begin.

This option can be necessary under a number of given situations:

- Should you wish to claim tax relief against a previous year by utilising the SEIS’s carry-back feature (or simply that your SEIS3 certificate was not received before the tax return deadline).

- Should you pay your taxes as an employee using PAYE (Pay As You Earn) and wish to gain tax relief through an adjustment of your tax code?

- Should you wish to claim income tax relief alongside capital gains reinvestment relief?

Consult a qualified tax professional

While the information provided here outlines the basic steps for claiming various SEIS tax reliefs, it does not constitute formal tax advice. Before making any SEIS investment, it is advisable to consult a qualified tax professional. They can help ensure you maximize the range of available reliefs—including loss relief options—and that all compliance requirements (such as any necessary compliance statements or advance assurance documentation) are properly addressed.

Investing in EIS-eligible opportunities

Investing under the Seed Enterprise Investment Scheme (SEIS) framework offers the chance to support transformative British businesses, build a diversified portfolio of high-growth startups, and benefit from substantial tax reliefs. Although SEIS is undoubtedly one of the best tax-efficient investments available to UK investors, it is important to remember that investments in early-stage companies carry higher risks.

At GCV, we present a select range of meticulously curated SEIS investment opportunities each year—designed to deliver exceptional returns and significant tax benefits. Our dedicated investment team evaluates over 750 opportunities annually to ensure that only the best prospects reach our network.

Through GCV Labs, our venture builder team works closely with our portfolio companies to enhance their growth and scalability, providing deeper insights and robust support in areas such as app development and marketing strategies.

Join GCV Invest, our exclusive network for experienced investors, and gain access to SEIS-eligible opportunities targeting attractive returns. Discover how these investments can work for you by using our SEIS calculator to explore the potential financial advantages and tax reliefs available.

It is equally important to understand the risks associated with these tax reliefs. By joining GCV Invest, you can ensure that you are well-informed and prepared to navigate both the opportunities and challenges of SEIS investments.

%20(3)%20(2).jpg)