Investors Target Tax-Efficient Investments ahead of Upcoming Tax Raise

Investors expecting Rishi Sunak to announce a raise in taxes in the coming months are investing millions of pounds through tax-efficient methods to protect their capital.

In the third and fourth week of November alone, over £10 million was invested through tax-efficient methods that support start-ups and small businesses. The figure, 56% higher than the previous two weeks, directly followed the release of a Government report into the rise in capital gains tax (CGT).

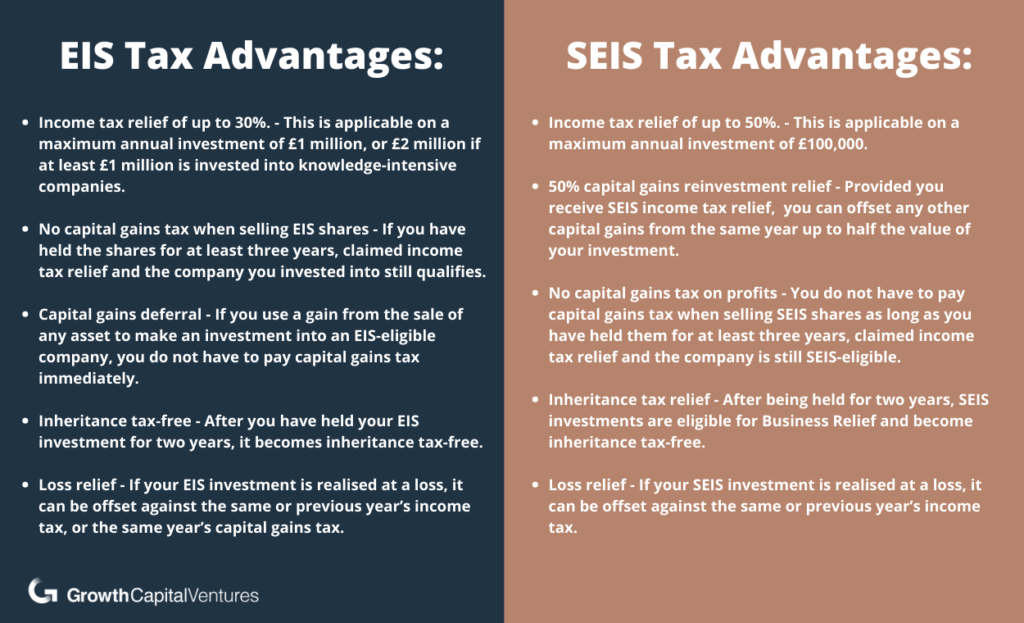

The Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS) were among the most popular methods chosen by investors to shelter their capital – offering up to 30% and 50% income tax relief on the value of an investment, respectively.

Swapping stocks for EIS

Financial analysts are suggesting investors are swapping more volatile, high-risk assets such as stocks & shares for tax efficient investments, after a review by the Office of Tax Simplification (OTS) suggested raising the rates of CGT (the charge paid by investors on profits when their shares are sold) in order to align them with income tax rates.

This rise, in theory, would mean that a higher rate income taxpayer would pay 40% tax on their profits, where currently the figure stands at just 20%, and additional rate taxpayers would pay 45% instead of the present 20% charge.

In addition to this, second-home owners and landlords would be impacted directly due to the CGT they pay on capital gains. It was also revealed by the OTS that by lowering the CGT threshold from £12,500 to £4,000 a further £70 billion could be raised over the course of five years to help combat the costs of the pandemic.

With both the EIS and SEIS benefitting from zero Capital Gains Tax when investors come to sell shares (providing they have been held for over three years), the two tax-efficient vehicles have been highlighted as a huge benefit by investors following the OTS announcement.

Discover: Live SEIS-Eligible Investment Opportunity

A recent industry report found that £9.65 million was invested into start-up backed funds, in the two weeks following the OTS report, compared with £6.2 million in the two weeks before.

Of the funds selected by investors, the EIS and SEIS were two of the most popular , not only due to their considerable rates of income tax relief and capital gains tax omission, but because of the full range of tax reliefs on offer that help minimise investor risk and maximise returns:

A growing tech focus

Although investors are able to invest in businesses within a range of industries with the EIS and SEIS, the pandemic has forced a significant shift in trend towards investing in high growth tech start-ups.

The technology sector as a whole has been one of the few parts of the UK’s private sector to perform well during the gruelling coronavirus pandemic, with 72% of UK tech witnessing an increase in demand for their services between March and August 2020.

This is largely due to the key role technology has played in the nation’s adjustment to the ‘new normal’, with people cut adrift from the physical world, digital solutions have become increasingly important for both consumers and businesses to connect, work, and ultimately survive.

Reflected in the EIS & SEIS frequent focus on tech firms, this impact of tech businesses has been seen within the venture capital contributions – £10.1bn being invested into UK tech firms in 2019 alone, with an equally high total being expected in 2020.

This combined growth of both UK tech and tax-efficient investment channels has meant investing into tech start-ups through vehicles such as the EIS and SEIS has never been so appealing to investors.

Live SEIS-Eligible Investment Opportunity

Innovative software as a Service (SaaS) tech start-up N-gage.io has launched a new SEIS-eligible investment opportunity on the GCV co-investment platform.

The start-up aims to transform the visitor, fan and customer experience through technology, and in its latest opportunity is looking to raise £150,000.

Fame Media Tech is part of the Audience of the Future revolution, where storytelling and innovation in digital media and mobile technology come together to captivate and engage audiences across the globe whilst creating more loyal and engaged customers, fans and visitors.

Sport, hospitality and the visitor economy have all suffered from customer and fan isolation during COVID-19. Now these sectors need to think differently about how they can introduce and enhance digital experiences to create engagement and improve customer loyalty at a critical period.

To address this opportunity Fame Media Tech is building n-gage.io – a highly customisable and configurable technology platform that combines storytelling with industry-leading tech.

Using the likes of augmented reality, and innovative web-app technology, Fame Media Tech strives to revolutionise the customer engagement process at visitor attractions, public destinations and sporting events, and ultimately drive customer loyalty and retention through its unique value proposition.

To discover more about this exciting SEIS-eligible opportunity with a high-growth tech start-up, register your interest and download the information memorandum.

%20(3)%20(2).jpg)