The future of property investing: alternatives to buy-to-let

Buy-to-let has been a bastion of UK property investing for many years. The premise is appealingly straightforward: identify a property in an area of high local demand, establish that the revenue generated by letting the property will exceed the costs of purchasing and maintaining it, and seek to benefit from consistent rises in house price that will deliver growth in the value of the property.

Furthermore, macroeconomic conditions in the twenty-first century have been incredibly favourable for buy-to-let investors:

- Stable, low interest rates reduced the cost of borrowing capital. Cheaper borrowing reduced the cost of buy-to-let and, consequently, increased the potential profit margins achievable by investors.

- The 2008 financial crisis led mortgage lenders to impose tighter lending criteria on borrowers, particularly those requiring higher loan-to-value ratios. This made purchasing homes more difficult and many aspiring homeowners instead continued to live in private rental accommodation. This trend sustained – and, in cases where supply of private rentals struggled to meet demand, increased – rental income for landlords.

UK housing overview

The UK Government, in its 2017 Housing White Paper, described the housing market as “broken”. The social importance of housing can not be overstated; this has been recognised by independent commentators as “critical to individuals' long-term financial security” and as “a driver of social mobility”.

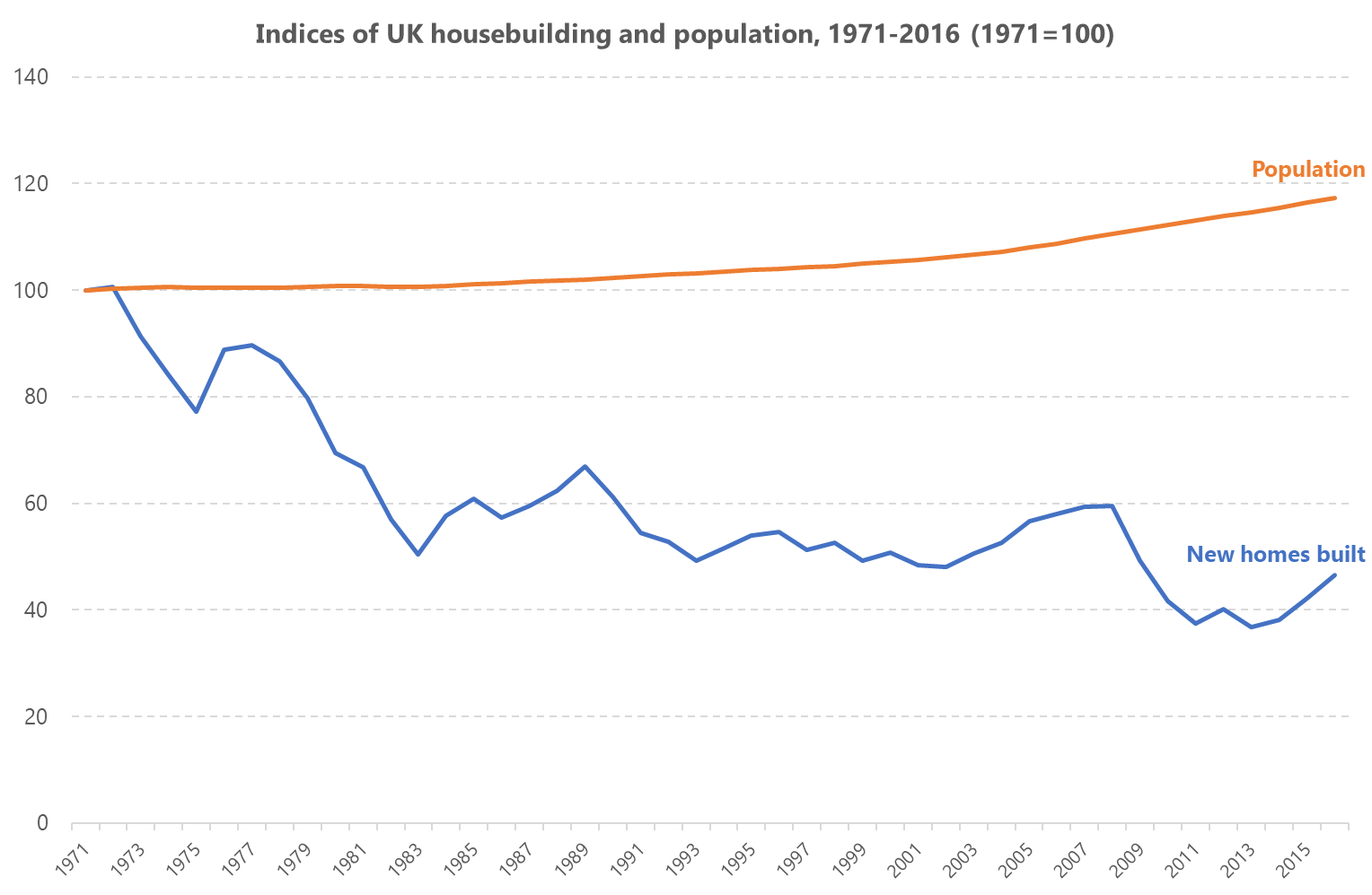

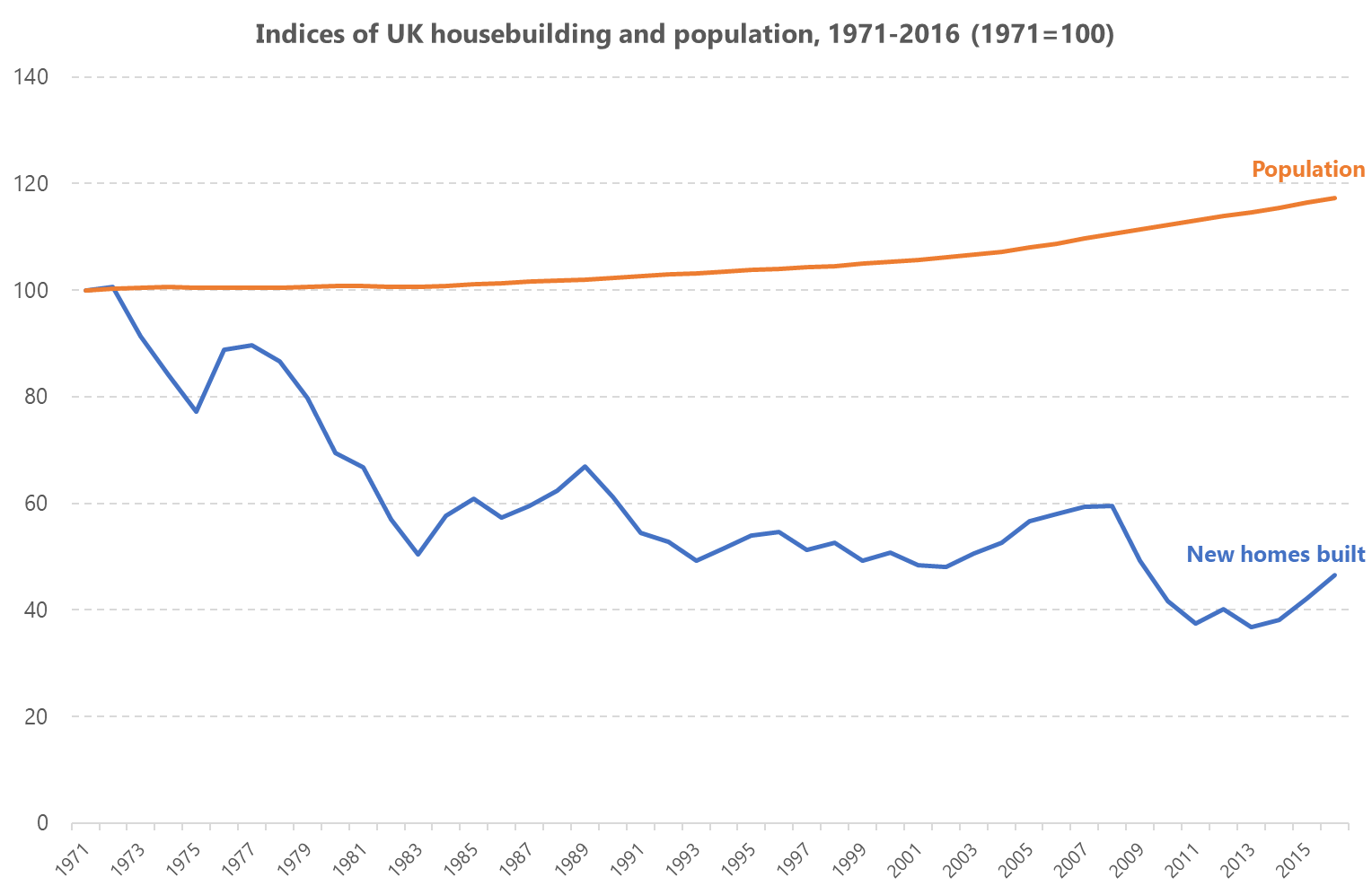

This desire to affect structural change in the residential property market manifests itself primarily in a commitment to increase housebuilding in the UK. This is a worthwhile ambition; the chart below demonstrates that population and housebuilding trends have diverged for 45 years.

The changing role of buy-to-let

A secondary, more subtle issue is a sense that buy-to-let investing has disrupted the housing market. Buy-to-let investors can purchase chain-free and, sometimes, with capital sufficient to buy properties outright. This makes them more appealing to vendors. In this context, measures to tame the dominance of buy-to-let investors have been introduced in both the 2016/17 and 2017/18 financial years:

- In April 2016, a stamp duty premium was added to property transactions that are not the purchaser’s own home. This affects buy-to-let investors in England, Wales and Northern Ireland (Scotland operates a different system). A premium of 3 percentage points was added to each of the existing stamp duty bands, set out in the table below.

| Purchase price |

Stamp duty rate – own home |

Stamp duty rate – subsequent |

| less than £125k |

0% |

3% |

| £125k to £250k |

2% |

5% |

| £250k to £925k |

5% |

8% |

| £925k to £1.5m |

10% |

13% |

| rest over £1.5m |

12% |

15% |

- In April 2017, the treatment of mortgage interest within the tax system was altered. Previously, tax relief was available at the marginal rate of tax paid by the individual. So higher-rate and additional-rate taxpayers could claim tax relief on mortgage interest paid on buy-to-let properties at an effective rate of 40%/45%. Tax relief on mortgage interest paid on buy-to-let properties is now restricted to a flat rate of 20%.

The impact of recent legislation

These changes are modelled below to demonstrate the impact that they would have on Raquel, a buy-to-let investor purchasing a property for £211,672 (the UK average house price in Q3 2017).

Stamp duty premium

In January 2016, the stamp duty due on this purchase would have been £1,733, representing 0.82% of the purchase price. In September 2016, the stamp duty due on this purchase would have increased to £8,084, representing 3.82% of the purchase price.

The introduction of the premium rate of stamp duty has, since April 2016, left buy-to-let investors facing an additional stamp duty liability of £6,351 on the purchase of a house of average value.

Restrictions on tax relief

As outlined above, this change impacts upon higher-rate and additional-rate taxpayers. Raquel is paid an annual salary of £55,000 in 2017/18 and pays higher-rate tax at 40%. If she was to earn a 5.5% gross rental yield on her buy to let property this would add an additional £11,642 to her earnings, totalling £66,642. Annual interest payments on a mortgage for 75% of £211,672, at a rate of 3.49% would total £5,520.

Before the change to the tax relief, Raquel would reduce her taxable earnings from £66,642 to £61,122 and reduce her tax liability by £2,208 (from £14,956.80 to £12,748.80). Under the new regime, her tax relief is fixed to 20% of her £5,520 mortgage interest. This halves the tax relief to which she is entitled; from £2,208 to £1,104. Raquel will pay an additional £1,104 tax under the new system.

What is the outlook for buy-to-let?

Properties already owned by buy-to-let investors will not be affected by the stamp duty premium. This measure is unlikely to have any impact on the rental yield generated by properties that are currently owned as buy-to-let. However, it could reduce their resale value; purchasers that want to retain the property as a buy-to-let will incur the stamp duty premium.

The tax reform has the potential to have greater immediate impact. However, seasoned investors with multiple buy-to-let properties often establish a corporate structure to own their properties. In this case, the financial impact of changes to personal tax relief will not be a consideration. Accidental or casual landlords are more likely to be affected, although midway through the first financial year of implementation may be too soon to discern any impact.

What are the alternatives to buy-to-let?

In this context, investors who have previously made regular investments into buy-to-let properties, or aspiring property investors looking to make their first investment, may find buy-to-let less compelling than in the past. Fortunately for investors, the growth of fintech has led alternative investment platforms – such as GrowthFunders and GrowthLenders – to embrace property investments alongside growth SMEs.

Making equity investments in property through SPVs offers a range of investor groups the opportunity to invest alongside one another and take on the role of property developers. As equity investments, the return on investment would come in the form of capital growth, an outcome that is traditionally considered a long-term objective. Equity investments in property offer the potential for elusive, rapid capital growth.

Investing in property through a peer-to-peer lending platform offers a different proposition. Investors lend money to property developers, who agree to a repayment schedule that includes the capital alongside an agreed rate of interest. This provides greater clarity over when capital should be repaid.

However, the interest payments that constitute the return on investment are, like rental yield, treated in the UK tax system as additional income and taxed at the individual’s marginal rate. The introduction in April 2016 of the Innovative Finance ISA (IFISA) provides a structure through which individuals can make investments in property through peer-to-peer lending platforms and accrue returns free of tax.

Residential property is an established asset class favoured by UK investors because it has historically provided strong returns through investments that are easy to understand. The reasons that property has been popular over the long-term – strong and sustained demand – will endure. The models through which investment most appeal to investors are changing; our guide and webinar lead you through these in more detail, including worked examples in the guide.

%20(3)%20(2).jpg)