The Millennial approach to finance and investments

Demographic change is constant; many businesses continuously review and modify their products and services to respond to market demand driven by this change. The smartest businesses make these changes before the need becomes apparent to their consumers.

Although demographic change is constant, market analysts often seek to group people together by age group if they also share a broader range of characteristics. Think Baby Boomers - not an entirely homogenous group, but with sufficient common characteristics to be both a credible cohort for analysis and to enable members to self-identify.

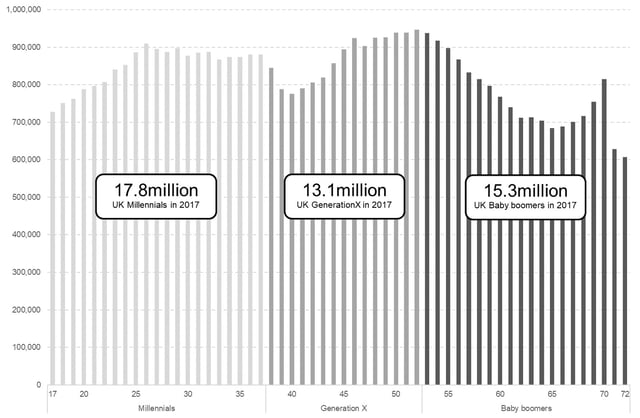

The growth, both in number (see chart, above) and financial maturity, of Millennials places them at the top of the contemporary business/cultural tree. You’ll no doubt already be familiar with the characterisation - digital natives, looser affiliations with established social structures, stronger affiliations with brands, socially and economically liberal, and more likely to blur boundaries between work and leisure.

How do Millennials approach personal finance?

Much of this is implicit in the characterisation; we would expect Millennials to be comfortable using modern technology to manage their financial interests; to embrace innovative disruptors of established markets, demand transparency in the way their finances are managed, and to be decisive in switching financial products if their expectations are not being met.

This 2016 piece from the FT does a great job of summarising how Millennials' generic characteristics overlay their financial behaviours.

Further factors that impact on Millennials’ financial considerations include:

- As summarised by Deloitte, millennials are more likely than previous generations to aspire to own their own businesses and, as the descendants of baby boomers, their prospective inheritance could bring about a sudden change in their financial clout. This could be most apparent as an increase in their liquid assets should they choose to sell the family home.

- Increased property values and the difficulties Millennials experience purchasing their first home impact upon them in two ways. Firstly, the need for a cash deposit provides an imperative to identify a financial product that will increase in value (and ideally do so more quickly than property). Secondly, for millennials living with parents (estimated to be between 27% and 30%), they have the financial means to command attention as an influential investor group.

- The 2008 global financial crisis was experienced in young adulthood by millennials. Analysis suggests that this has had a lasting impact; millennials are less likely to trust established providers of financial services with their cash. This creates a market opportunity for Fintech innovators, such as equity co-investment platforms like ours, digital challenger banks such as Atom, and peer-to-peer (P2P) lenders, examples of which include Ratesetters.

Based on the various factors that influence their financial circumstances, analysis of how Millennials’ are responding have already been completed:

- Research by PwC into banking demands found that 18-24 year olds were 3x as likely (39% vs 13%) as 55+ year olds to consider a mobile app an essential part of the bank’s offer. This provides encouragement for the digital challenger banks that focus on the digital user experience over more traditional high street banking.

- Research by Dunstan Thomas found that 45% of Millennials are already regularly using banking apps on their smartphone/tablet.

Millennials’ investment outlook

Taking this analysis into consideration, one of the most pertinent questions comes into the form of how are Millennials actually approaching investments?

- Millennials are integrating their preference for digital into their investment activity. 12% of Millennials are already using online investment platforms. Various alternative finance providers have targeted this market, from the established P2P business lending, through to niche products that enable consumers to round the cost of small purchases up to the nearest pound and invest this.

- Millennials are quick to get rid of investments that are not meeting their expectations. Shroders 2016 Global Investor Study found that Millennials hold their investments for 2.3 years on average, compared to 3.9 years for older groups. Perhaps this is because Millennials’ expectations are higher: in terms of income, Millennials on average expected their investments to deliver 10.2% per year, compared to 8.4% per year amongst older investors. This impatience goes against conventional wisdom, which encourages a long-term investment outlook to insulate.

- Millennials attitudes towards risk remain unclear. Research by FTI consulting found that 92% of those aged 18-30 felt that early-stage equities (one of the riskier asset classes) would help them achieve their financial goals, compared to just 49% of those aged 50+. In contrast, research by UBS suggests that Millennials’ risk tolerance is more conservative than their Generation X predecessors and that their preferred asset allocation contains more than twice as much cash (52%) as other cohorts combined (23%).

Millennials face a challenging combination of financial circumstances. They want investments that offer rapid growth and high liquidity (perhaps because they intend to use their capital as a deposit for a home). This represents a tough brief for even the most experienced of investors.

Technology enables Millennials to structure and restructure their investments with greater immediacy, but it doesn't eliminate some established wisdoms:

- Investment values can be volatile in the short-term and still achieve long-term growth

- Diversification is an essential and valuable way to mitigate risk

- If liquidity really is top priority, cash will always be king

Conclusively, Millennials continue to be one to watch and further analyse, especially with the rapidly changing FinTech offering of the sector, but other demographics shouldn't be overlooked as a changing world creates altered behaviours for all.

%20(3)%20(2).jpg)