UK Tech Jobs spike since peak lockdown

Recent data from specialist recruitment agency Otta, has revealed an incredible 3,495 tech roles were advertised in September throughout the UK, as figures draw closer to the pre-lockdown high of 3,552 in March.

The rapid bounce-back in job availability comes as a 71% increase has been recorded since June, a recovery yet to be matched by any other part of the private sector.

Supported by a 40% increase in digital jobs in the UK over the past two years, the figures have cemented tech’s key role in driving post-pandemic employment, even gaining the sector special priority in The Chancellor’s ‘Kickstart’ employment scheme.

What’s driving this growth?

The pandemic has been undoubtedly significant in driving this demand for tech roles, partly due to the rapid acceleration of tech investment by SMEs following a sector-wide shift towards remote working.

A recent industry report surveying 937 professionals worldwide, revealed that 31% of organisations planned to provide further IT training for personnel following an increase in remote working, compared with a pre-pandemic figure of just 19%.

As the level of remote and hybrid working within firms in the private sector is predicted to continue increasing through till 2021 and beyond, a higher proportion of tech-oriented roles will be crucial to fulfil this digital demand.

According to research by global HR agency Robert Half, tech skills now top the list of business priorities going into 2021, with software development, cloud migration and project management experience being the most sought after traits by hiring managers for the coming year.

But remote working hasn’t been the only implication of the pandemic that’s driven this growing desire for tech roles.

The increasingly widespread digitisation of services and systems, everywhere from conducting work meetings via zoom to ordering food digitally at a restaurant, has forced businesses and personnel in almost every industry to grow, adapt and compete technologically now more than ever.

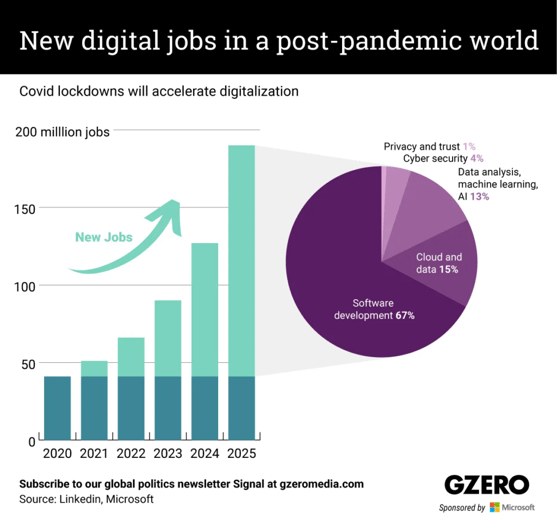

Of the 149 million new jobs forecasted by Microsoft to be created by 2025 as a result of the pandemic, software development jobs are predicted to account for 65%, cloud and data 15%, and data analysis and machine learning at 13%, as those in tech jobs capitalise on the advancement of post-pandemic digitalisation.

New digital jobs in a post-pandemic world, Gzero 2020.

UK tech investment continues to grow

Contributing £149bn to the UK economy and accounting for to 7.7% GVA in the same year, digital tech grew 6 times faster than any other industry in the UK in 2018, largely attributed to a rapid increase in investment the sector has experienced.

£10.1bn was invested into UK tech companies in 2019, signalling yet another record breaking year for venture capital contributions.

A £3.1bn increase from the previous year’s figures, in 2019 the UK received a higher level of investment into tech firms than Germany and France combined.

These consistently high investment figures have placed the UK as one of the most heavily tech-invested nations on the planet.

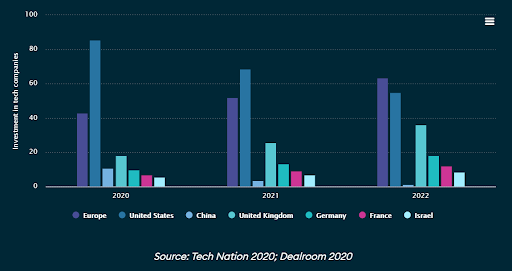

The 2020 Tech Nation Report shows the United Kingdom currently experiences the third highest level of investment in tech companies globally, with only the US and China boasting higher volume of venture capital invested.

Perhaps more encouragingly, with the 71% increase in series C investment and 51% rise in Growth Equity (Private Equity) noted over the past year, the UK tech ecosystem appears to be perfectly primed for the scaling and growth of new tech startups.

And whilst other areas of the private sector have appeared to be struggling throughout the pandemic, investment has continued to flow into the tech sector over recent months, as the total level of investment into UK tech startups increased by an significant 34% between March 23rd and April 27th.

Predicted growth in tech investment

Not only have the implications of the COVID-19 pandemic appeared to have positively impacted UK tech investment, but it is expected that investment will continue to grow as a result of the pandemic.

Extrapolating data from it’s previous years’ figures, The Tech Nation report predicts tech investment will continue to rapidly increase in future years, almost doubling in value within the next two years to £36.2bn.

Forecast tech investment 2020-2022, The 2020 Tech Nation Report.

Tech startups key to economic recovery

672,890 new startups were recorded in the 2018/19 tax year, at an average of 1,834 founded per day.

Tech startups in particular have been highlighted as growing throughout the past year, with research for the Digital Economy Council revealing over £4.2bn has been invested into young UK-based Tech companies between January and June 2020.

These small, equity backed, tech businesses set up across the UK are already proving to be vital in the nation’s economic bounceback, kick-started by the Chancellor’s ‘Plan for Jobs’ in July.

Since the pandemic, the innovation of new ideas, systems and services tech startups bring are forcing the next wave of technology in the midst of one of the most influential black swan events of a generation.

Though early stage companies are already spearheading the push for a post-pandemic economic recovery, more must be done to support the future business landscape.

Norm Peterson, CEO of Growth Capital Ventures, commented:

After the furlough scheme ends, additional government support will be needed to preserve jobs but there must also be a focus on creating new job opportunities in key industries such as the technology sector.

As consumers and businesses rely more on technology as a result of COVID-19, we need to enable the creation and scaling of the UK’s next wave of innovative start-ups and fast-growth SMEs. Building these sustainable businesses and supporting entrepreneurs and innovators is going to be critical to the UK economic recovery.

These changing times and schemes such as Coronavirus Business Interruption Loan Scheme (CBILS) have shown just how much businesses have benefited from access to capital when they need it most. The government must therefore consider additional measures that support businesses in tax-efficient ways.

Norm added:

Tax-efficient structures such as the Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS) can help businesses to reduce their tax liabilities and leverage growth. The government may also consider more generous tax relief on venture capital schemes that can act as a catalyst for business growth.

At Growth Capital Ventures we’ve spent several years bringing together a network of experienced private investors and institutional investors to co-invest in high growth investment opportunities that utilise these tax-efficient structures so businesses can take advantage of generous tax reliefs.

It’s important that alternative finance streams are opened up to SMEs so they can propel a sustained economic recovery; if this happens, there will be less need for the government to.

Investing in growing tech

Earlier in September Growth Capital Ventures launched a £1 million funding round on it’s co-investment platform. The live investment opportunity will drive growth and deliver impact, placing growing British tech firms at the forefront of its mission, at a time where investing in tech has never been so crucial, or lucrative.

The investment round has already gained momentum with over £1.2 million of investment secured from institutional and individual investors via Growth Capital Ventures private investor network G-Ventures.

The capital raised will enable Growth Capital Ventures to support 30 high-growth start-ups and create hundreds of new tech jobs within the North East through its venture builder unit, G-Labs.

Alongside contributing to innovative scale-ups, job creation and expanding the UK tech sector, capital invested into the raise is EIS eligible, meaning investors can benefit from valuable tax incentives on an investment that targets 12.9x money-on-money returns.

%20(3)%20(2).jpg)