What is the inheritance tax threshold in the UK?

As of the 2024/25 tax year, the IHT threshold below which an estate is not subject to inheritance tax (IHT) is £325,000 in the UK. If the total value of your estate is above this figure, inheritance tax may need to be paid on the amount that exceeds the tax-free allowance.

However, there are a number of additional rules that you could consider when calculating the amount of IHT your estate may attract (which you can do using an inheritance tax calculator), as generous tax reductions can often be achieved by meeting certain criteria.

How does the inheritance tax-free allowance work?

Unlike some taxes, inheritance tax is levied on an estate, rather than an individual person. An estate can consist of any assets, such as property, investments, savings and possessions, minus any liabilities, such as debts and reasonable funeral costs.

All estates in the UK are entitled to benefit from the main inheritance tax-free allowance, also known as the nil-rate band, of £325,000. However, it is still important to monitor the value of your estate, even if it is currently below this nil-rate band, as any future rises in value could attract an inheritance tax liability. This is because IHT applies to the value of your estate at the time of your passing.

If your estate is worth more than £325,000, your beneficiaries may face an inheritance tax rate of 40% on some of the assets they inherit from you. So, considering ways to reduce a potential inheritance tax bill and making full use of the available thresholds can be crucial in order to pass on as much wealth as possible to your loved ones.

For example: An individual has an estate of £800,000. The nil-rate band of £325,000 is fully utilised, so a taxable estate of £475,000 remains. The standard inheritance tax rate of 40% is due on this remaining amount, meaning that HMRC would collect £190,000 in IHT from this estate, and a further £285,000 could be passed on to loved ones, in addition to the initial £325,000.

Overall, if no tax-efficient investment strategies or additional rules are followed, an estate of £800,000 would pay £190,000 in inheritance tax, and could pass on a total of £610,000 to beneficiaries.

What is the residence nil-rate band?

In addition to the standard nil-rate band of £325,000, the residence nil-rate band (RNRB) was introduced from 6 April 2017, offering a further £175,000 inheritance tax-free allowance to be utilised when residential property is left to your direct descendants.

Certain criteria must be fulfilled for the nil-rate band to be utilised, including:

- You must own, or partly own, a property in which you have lived, on or after 8 July 2015. This is known as having a qualifying residential interest.

- This property must be ‘closely inherited’, meaning that it is left to any of your direct descendants, including children, grandchildren, great-grandchildren, stepchildren, adopted children, foster children, or a child to which you were appointed as a guardian when the child was under 18.

Several other conditions relating to the residence nil-rate band should be noted, including:

- This tax-free allowance can only be used on one property per estate.

- The amount of the RNRB that can be used is dependent on the value of the property in question. For example, if the property is worth £150,000, only £150,000 of the residence nil-rate band could be utilised. The remaining £25,000 of the RNRB allowance cannot be used on any of your other assets or property.

- If you are married or in a civil partnership, any unused RNRB can be transferred to your surviving partner. It could be the full amount (£175,000), or only part of this figure if some has been used.

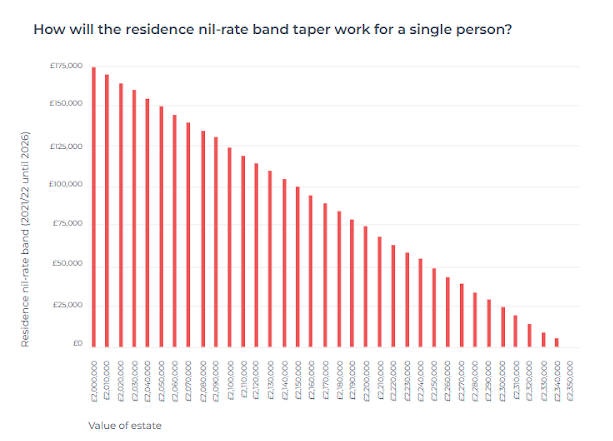

- ‘Large estates’ are classed as those exceeding £2 million, based on the total value of assets at the time of the owner’s death, not including any lifetime gifts made – even if they were made within seven years of death and are included in the IHT calculation. These estates are subject to RNRB taper relief. This means that, for every £2 that the estate exceeds £2 million, the amount of residence nil-rate band available will decrease by £1.

For example: An individual’s estate is classed as a ‘large estate’ and is valued at £2.1 million at the time of their passing. As the maximum figure to benefit fully from the RNRB (£2 million) is exceeded by £100,000, the residence nil-rate band available for this estate will decrease by £50,000, taking the figure to £125,000 as opposed to £175,000.

For an even larger estate, valued at £2.35 million, no residence nil-rate band is able to be utilised at all. This is because the estate exceeds the maximum figure to fully benefit from the RNRB by £350,000, and so if the RNRB decreases by half of this figure (£175,000), it would no longer be available at all.

How much wealth could I pass on, tax-free, using the current IHT thresholds?

As announced by ex Chancellor Jeremy Hunt in the Autumn Statement 2022, both the standard nil-rate band and the residence nil-rate band are frozen at their current thresholds (£325,000 and £175,000, respectively) until April 2028.

This means that more estates could potentially fall into the inheritance tax trap as the value of property, income, other investments and overall personal wealth may rise over the next five years.

Read More: How to avoid inheritance tax: key considerations and strategies

Subsequently, being able to fully utilise both nil-rate bands could take your overall individual inheritance tax-free allowance to £500,000 and enable greater amounts of wealth to be passed on to your loved ones, free of IHT.

Furthermore, making the most of tax-free transfers between couples could potentially double the £500,000 individual allowance to £1 million for a surviving spouse or civil partner.

This is because, if you are in a married couple or civil partnership, you can leave your entire estate, regardless of its value, to your surviving spouse or civil partner – completely free of inheritance tax.

This would mean that your own nil-rate bands would remain fully unused, and these can then be transferred to your surviving spouse or civil partner’s estate, ultimately doubling their potential tax-free inheritance tax threshold from £500,000 to £1 million (if both residence nil-rate bands are able to be utilised fully).

The bottom line

Ultimately, all individuals are entitled to the £325,000 standard nil-rate band, and for individuals who own a property that fits the criteria, this individual threshold could rise to £500,000.

For married couples and civil partners, the main nil-rate band could be transferred, leaving the surviving partner with a threshold of £650,000. Or, the residence nil-rate band – as well as the standard nil-rate band – could potentially be transferred, creating an tax-free inheritance threshold of up to £1 million.

These thresholds can help to mitigate, or even perhaps fully negate, an inheritance tax liability on your estate.

However, for those with particularly large estates – such as high-net-worth individuals and sophisticated investors with considerable investment portfolios – these inheritance tax thresholds may only affect a small portion of the estate.

As a result, taking further steps to avoid inheritance tax, such as minimising inheritance through tax-efficeint investments, setting up a trust, or gifting assets during your lifetime, could add greater value to your overall IHT-planning strategy and help to leave as much wealth as possible to your loved ones.

%20(3)%20(2).jpg)