GCV Announces £1m Fundraise set to Create Jobs & Scale up Tech Firms

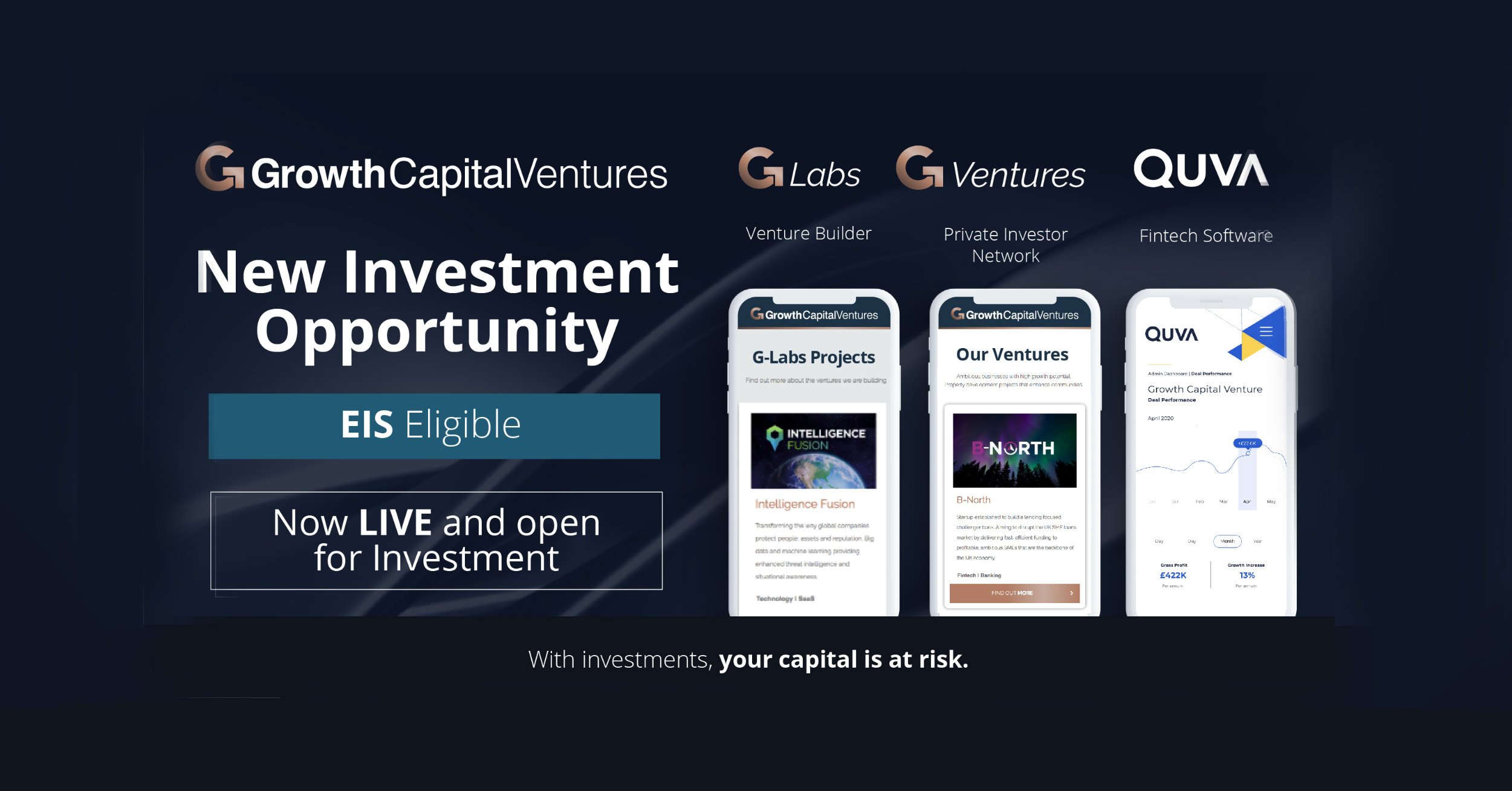

Growth Capital Ventures are thrilled to announce the launch of their latest investment round now open to new and existing private investors via its online investment platform – growthfunders.com

The investment round has already gained momentum with £1 million of growth capital secured from institutional investors to continue its expansion and fast-track the growth of Britain’s burgeoning tech sector.

Discover More: GCV Live EIS Eligible Investment Opportunity

Investment from the current round will enable GCV to support 30 high-growth start-ups and create hundreds of new tech jobs within the North East through its venture builder unit, G-Labs. It will also enable GCV to increase internal headcount from 22 to 40 in the next 12-24 months.

Launched in 2015, by co-founders Norm and Craig Peterson, Growth Capital Ventures has evolved over the last 5 years, but the mission has remained focused: to back the game changers, the innovators and value creators. Those who make a positive difference to the way we live and work.

The funding round announcement also follows the recent emphasis the UK Government has placed on the tech industry to fuel the bounce-back of the economy post-COVID, devising plans to boost the fintech sector in particular after UK GDP dropped by 19.1% in the three months to May 2020.

According to data collected by trade body Tech Nation, prior to the pandemic in 2019 investment in the UK tech sector witnessed a £3.1 billion increase which resulted in a record £10.1 billion of annual investment, these figures justifying the industry’s status as a key driver for economic growth and future job creation.

GCV is very much immersed in this important sector, having facilitated over £45m of investment into high-growth tech businesses. From innovative employee engagement platform Hive HR to challenger bank Atom Bank, GCV has contributed to the creation of over 600 jobs in the past five years.

Craig Peterson, co-founder and chief operating officer at GCV, said: “Over the past five years we have been on a mission to support entrepreneurs and innovators to build and launch high-growth businesses that transform industries.”

“The fundraise will not only increase our capacity with further quality hires and expand our venture builder arm but in turn will enable the creation and scaling of the UK’s next wave of innovative tech start-ups.”

“As consumers and businesses are relying more on technology as a result of COVID-19, we feel this investment comes at the right time to combine capital and intensive support to build better, more sustainable businesses.”

Discover more about GCV’s latest investment round on the GrowthFunders platform

Three core units working together to drive growth

Following the company’s initial inception in 2015, GCV has evolved rapidly. The business originally began its journey as a fintech company, developing and operating online investment platforms focused on alternative investments.

Formally launching their first platform GrowthFunders.com in 2015 the company has since developed a core body of innovative internal units:

A private investor network, a specialist fintech software division and an innovation lab – each business division working cohesively to drive growth, create value and deliver impact.

GCV’s private investor network known as G-Ventures comprises an extensive range of experienced private and institutional investors, G-Ventures operates both online and offline networks and serves as a valuable platform for members to co-invest in high growth focussed investment opportunities.

Over the past few years the network has established a proven track record of backing impact driven, growth focused opportunities that transform industries, from high-profile fintech businesses such as Atom Bank and B-North, to growth focused tech startups like global intelligence provider Intelligence Fusion and innovative self-service system operator Qikserve.

Facilitating investment opportunities across three core assets of venture capital, property and private equity, GCV utilises tax efficient structures in their origination of opportunities for the G-Ventures network, employing the Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS) wherever possible to ensure investors can take advantage of generous tax reliefs available.

GCV’s innovation lab and venture builder arm (G-Labs) invests capital, knowledge, experience, ideas and infrastructure to help tech entrepreneurs incubate business opportunities in high growth sectors.

Developing ideas from the initial launch stage to scale, maturity and exit, this approach also provides the G-Ventures Investor Network with access to high quality, well structured investment opportunities where developers and investors share mutual goals and interests.

The newest addition to GCV’s innovative business divisions is Fintech software Quva. Quva designs, builds and operates online investment and reporting platforms which look to streamline the investment process as a whole, providing an end-to-end solution for investment managers and investor clients alike.

For investment firms and asset managers operating throughout the alternative investment sectors, the platform-as-a-service software Quva has the capability to forge a niche within the sector and generate considerable enterprise value as a stand alone business unit.

Craig Peterson added: “Through our three business divisions we’ve developed a powerful approach to creating, launching and scaling high-growth businesses.”

“We have the capability to support the start-up and expansion of several ventures that have the capacity to add real value to the UK’s tech industry. This sector will be vitally important to the UK as the economy tries to recover from the devastating impact of the coronavirus.”

“Our aim now is to invest in and support exciting new projects that can build, launch and scale businesses, creating much-needed jobs at a time when employment is falling due to COVID-19.”

Investors now have the opportunity to contribute to GCV’s latest £1 million funding round now live on the GCV’s co-investment platform GrowthFunders until Monday 30th November.

%20(3)%20(2).jpg)