Weekly Briefing: IHT cuts on the table, Zoopla releases latest housing market insights & VC investment remains stable

This week, we look at potential IHT changes ahead of November’s Autumn Statement as well as recently released data on the Eurozone’s economic standing, the performance and outlook of the UK housing market, and more.

UK Tax Update

Chancellor Jeremy Hunt considering inheritance tax cut

- According to The Telegraph, Chancellor Jeremy Hunt is considering an inheritance tax (IHT) cut in the upcoming Autumn Statement as economic projections look up.

- The Office for Budget Responsibility (OBR) calculated that the Treasury is now around £5.5 billion in the black as Government borrowing falls, and the Chancellor is said to be opening up to the idea of non-inflationary tax cuts as a result.

- Any cuts will depend on whether the fiscal outlook improves further in the coming weeks, with Hunt due to receive one more update from the OBR before the Autumn Statement takes place on 22nd November.

- Speculated IHT reforms include reducing the headline 40% rate or allowing all families to pass on up to £1 million tax-free.

- The Chancellor has previously ruled out personal tax cuts over fears they would undermine efforts to bring down inflation.

Global Economy

Eurozone inflation slowed more than expected in October

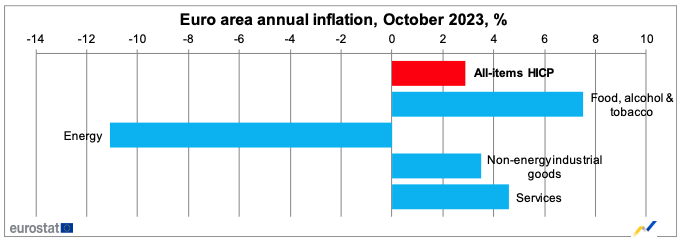

- Eurozone inflation has dropped to 2.9% in October, its lowest level in over two years, according to preliminary figures released in Eurostat’s Flash Estimate.

- The fall in inflation – down from 4.3% in September – comes as energy prices decreased and high interest rates set by the European Central Bank (ECB) dampened demand.

- Food, alcohol and tobacco is expected to have the highest annual rate in October at 7.5%, followed by services (4.6%), non-energy industrial goods (3.5%) and energy (-11.1%).

- The data is said to likely cement the view that the ECB is finished raising interest rates in its fight against high inflation.

- New Eurostat figures also show that Eurozone GDP fell by 0.1% in July to September, worse than the stagnation expected by economists.

- Germany shrank by 0.1% in Q3, whilst Italy stagnated and France grew by 0.1%.

Source: Eurostat.

Source: Eurostat.

Venture Capital

Venture capital investment is stable in the UK, according to KPMG

- KPMG’s Q3 Venture Pulse Report suggests that VC investment into the UK remained stable throughout the quarter even amidst investor caution.

- Between July and September, $5.2 billion (£4.2 billion) was invested into UK businesses, with 469 deals completed.

- $2.6 billion (£2.1 billion) across 219 deals was invested into UK businesses based outside London, and $2.6 billion (£2.1 billion) across 250 deals was invested into London-based businesses.

- The UK also accounted for five of the top 10 largest VC deals in Europe over the Summer months, including a $631.6 million (£517.7 million) Series A raise for Birmingham-based Conigital – which featured in the top 10 global deals for Q3 – and $355 million (£291.1 million) in late-stage investment into London-based Butternut Box.

- KPMG predicts that early-stage companies with proven cash flows at Seed and Series A stages will continue to form a large part of the deal volume for the remainder of 2023.

Property

Insights from Zoopla’s October UK House Price Index

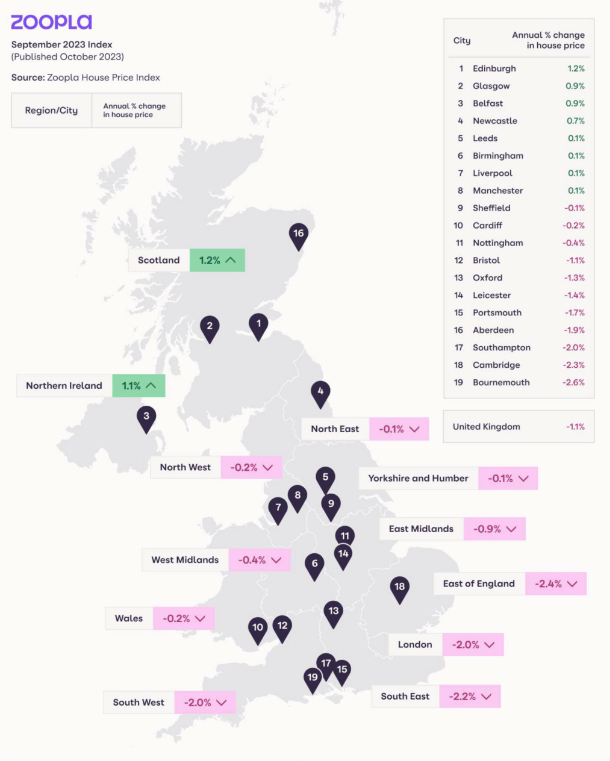

- Zoopla’s latest UK House Price Index report, released on 30th October, has provided an insight into recent market activity as well as forecasts for 2024.

- The report points out that “house prices have defied predictions of much larger falls in 2023. The economy continues to grow, albeit slowly, while unemployment remains low and incomes are increasing.”

- Housing demand in October was 25% below the five-year average, due to a jump in mortgage rates over the Summer months subduing activity.

- Four in five housing markets are registering annual price falls, but these are modest, with no markets registering falls of over 5%.

- The North of England – namely the North East, North West and Yorkshire and Humber – has experienced the most muted annual change in house prices behind Scotland and Northern Ireland, both of which saw positive house price change.

- First-time buyers (FTB’s) look set to be the largest buyer group in 2023 as demand has been supported by rapid rent growth, whereby in markets with lower house prices, average FTB’s mortgage repayments are lower than rental costs.

- Cash buyers are on track to closely follow FTB’s, accounting for one in three sales in 2023 (up from one in five over the last five years).

- Zoopla predicts that mortgage rates will fall to 4.5% by the end of 2024, whilst UK house prices will fall by an average of 2% over the year.

Source: Zoopla House Price Index.

Source: Zoopla House Price Index.

A Final Note

Overall, whilst there are clearly still challenges facing both the UK and wider global economy, falling Eurozone inflation, stable VC investment and a fiscal standing that is potentially positive enough to result in IHT cuts from the Chancellor should provide some tentative confidence in the outlook.

At GCV, we remain committed to providing the latest insights into the investment and wider economic landscape in order to support investors in making well-informed decision when choosing where to allocate their capital.

If you would like to find out more about a number of effective investment strategies in 2023, discover our range of downloadable resources here.

%20(3)%20(2).jpg)