Weekly Briefing: UK inflation falls to lowest level in two years, world economy to perform better than expected in 2024 & a housing market that has outperformed predictions

We take a look at the latest figures on falling UK inflation and a robust jobs market, Goldman Sachs’ predictions for the performance of the global economy in 2024, and more.

UK Economy

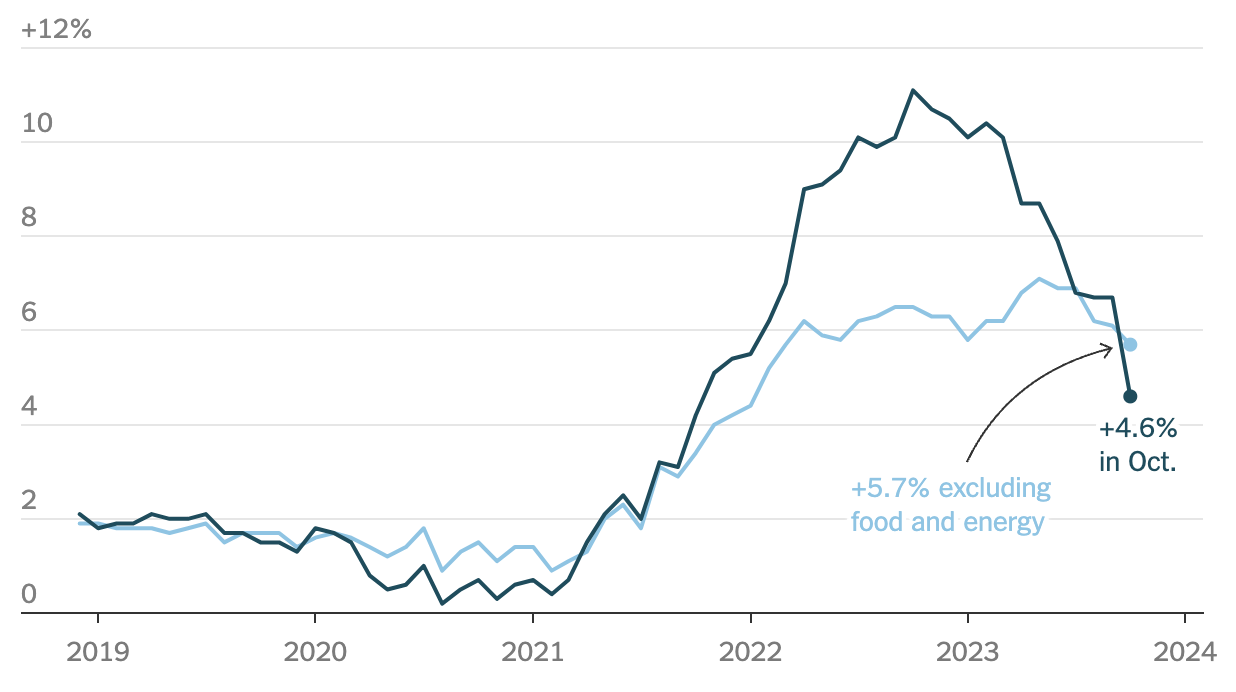

UK Inflation Falls Sharply to 4.6%

- The Office for National Statistics (ONS) have revealed that inflation fell to 4.6% in October, a sharp drop from 6.7% in September.

- This is the UK’s lowest rate of inflation in two years and it means Prime Minister Rishi Sunak has met his goal of halving inflation by the end of 2023 early.

- Economists have attributed cooling inflation – falling from a peak of 11.1% in October 2022 – to both the energy price cap and the Bank of England’s (BoE) previous decision to raise interest rates.

- The energy price cap was lowered to £1,834 for the average household in October, helping to drive falling inflation.

- Food inflation also slowed in October. Prices rose 10.1%, the slowest pace since June 2022.

- Core inflation, a measure which excludes food and energy prices, is falling more slowly, from 6.1% in September to 5.7% in October.

Annual Change in the UK's Consumer Price Index (CPI)

Source: ONS, The New York Times.

Source: ONS, The New York Times.

UK Jobs Market Avoids Hit From Economic Slowdown

- The latest ONS Labour Market Overview has recorded only a small fall in employment and the strongest rise in wages when adjusted for inflation in two years.

- In the three months to September, the UK’s unemployment rate remained stable at 4.2% and the employment rate dropped 0.1% to 75.7% over the same period.

- Annual growth for regular pay was 7.7% in July to September, a small decrease on the previous period (7.9%) but still among the highest annual growth rates since records began in 2001.

- When adjusted for inflation and considered in real terms, annual growth for total pay rose on the year by 1.1%, and regular pay rose on the year by 1%, the ONS said.

- Darren Morgan, ONS Director of Economic Statistics, said:

Our labour market figures show a largely unchanged picture. The number of job vacancies still remain well above their pre-pandemic levels. With inflation easing in the latest quarter, real pay is now growing at its fastest rate for two years.

Global Economy

World Economy to Perform Better Than Expected in 2024

- Goldman Sachs is expecting the global economy to outperform expectations in 2024, as it did in 2023.

- This outlook is based on their economists’ prediction of “strong income growth (amid cooling inflation and a robust job market), their expectation that rate hikes have already delivered their biggest hits to GDP growth and their view that manufacturing will recover.”

- On an annual average basis, economists surveyed by Bloomberg forecast worldwide GDP to expand 2.1% next year, whilst Goldman Sachs have more optimistically forecast growth of 2.6%.

- Their research has suggested that the Eurozone and the UK will both have particularly “meaningful acceleration in real income growth,” reaching around 2% by end-2024, as the gas shock following Russia’s invasion of Ukraine fades.

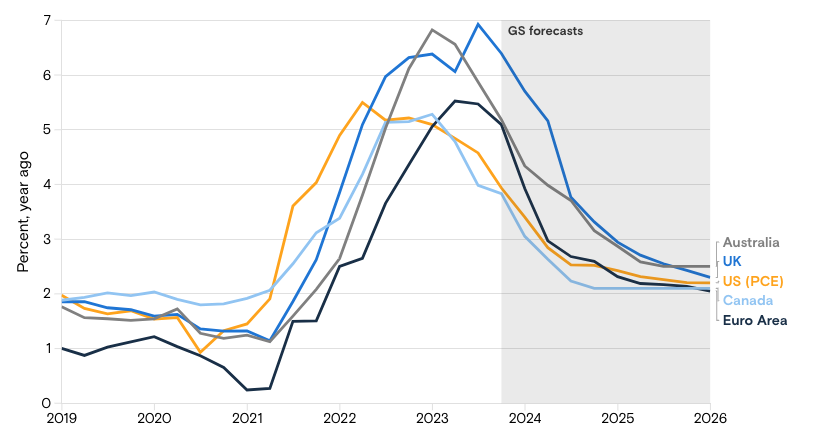

- Goldman Sachs is also expecting inflation across G10 and emerging market economies to continue to cool over 2024, getting to circa target-consistent levels by the end of the year.

Core Inflation Forecast

Source: Haver Analytics, Goldman Sachs Research.

Source: Haver Analytics, Goldman Sachs Research.

Property

Rightmove’s House Price Index Points to a Better-Than-Expected Year

- In its latest House Price Index, Rightmove has suggested that 2023 has been a better year for the UK’s housing market than many predicted following the turbulent end to 2022.

- Average asking prices are just 3% below May’s peak and sales agreed are 10% below 2019’s ‘normal’ market level, improving from 15% below last month.

- Wales, Scotland and the North of England have witnessed rises in the prices of newly-marketed properties, whilst there are yearly price declines in the Midlands and all Southern regions.

- According to Rightmove, the BoE’s last two consecutive base rate holds have helped to keep demand in line with 2019’s levels.

- Rightmove’s Director of Property Science, Tim Bannister, said:

This year has brought many new challenges for buyers, sellers and agents to navigate. While there have been many twists and turns, and there are still seven weeks left of the year, the data indicates that there has been more to be positive about in 2023 than many thought there would be. The upcoming Autumn Statement will now set the tone heading into 2024, particularly if there are any major policy announcements.

A Final Note

The considerable drop in the inflation rate is significantly positive news for the UK economy, as is the seemingly robust jobs market.

Moreover, Goldman Sachs’ global economy outlook also looks promising, and it altogether feels as though performance across the board this year has been better than predicted, making us optimistic for the remainder of Q4 and into 2023.

At GCV, we remain committed to providing the latest insights into the investment and wider economic landscape in order to support investors in making well-informed decision when choosing where to allocate their capital.

If you would like to find out more about a number of tax-efficient investment strategies in 2023, discover our range of downloadable resources here.

%20(3)%20(2).jpg)