Weekly Briefing: BoE Interest Rate Held For Sixth Time, Post-Election Tax Rises On The Table & Crypto VC Funding Surpasses $1 Billion For Second Month

In this week’s briefing, we check-in on the Bank of England’s (BoE) latest interest rate decision, discuss findings from a leading UK think tank that suggests post-election tax rises could be a possibility, and more.

UK Economy

BoE Holds Interest Rates For Sixth Consecutive Time

- The BoE has held interest rates at 5.25% – a 16-year high – for the sixth time in a row.

- The decision to maintain rates was not a unanimous one, with seven of the nine-member panel voting for a hold and two for a cut.

- According to BBC News analysis, August or September 2024 seems to be the most likely time for a rate cut, but if services inflation falls sharply in the next month, a June cut is possible.

- Andrew Bailey, BoE Governor, said: “We need to see more evidence that inflation will stay low before we can cut interest rates.”

- Bailey also stated that rate cuts may need to happen faster than markets are predicting, saying: “It's likely that we will need to cut bank rates over the coming quarters and make monetary policy somewhat less restrictive over the forecast period – possibly more so than currently priced into market rates."

Global Economy

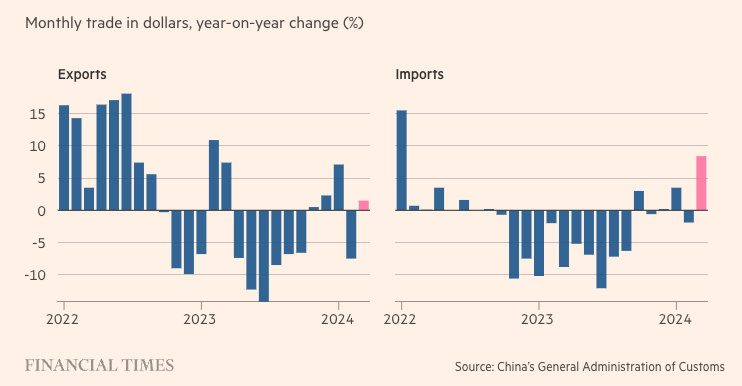

China’s Trade Returns To Growth

- A surge in China’s imports of critical equipment for developing artificial intelligence has driven a return to growth for the world’s second-largest economy.

- In the first four months of 2024, the value of China’s imports of automatic data processing equipment grew 50% year-on-year according to official statistics.

- The value of imports expanded 8.4% in dollar terms in April when compared with a year earlier, reversing a decline of 1.9% in March.

- Exports also expanded, rising 1.5% in April and overturning a decline of 7.5% in March.

- Lynn Song, ING’s Chief China Economist, said: “For imports, strength was heavily concentrated in a few categories. The main theme in our view is the goal to compete in the AI race.”

- Song stated that by comparison, other import categories such as agricultural products, coal and cosmetics remained “heavily in contraction.”

Venture Capital

Crypto VC Funding Surpasses £1 Billion For Second Consecutive Month

- According to findings from RootData, crypto venture capital funding exceeded the $1 billion mark for the second month in a row in April.

- The data found that the sector witnessed $1.02 billion in funding spread across 161 investment rounds in April, a marginal decrease from March’s $1.09 billion across 186 investment rounds.

- This is the first time since October/November 2022 that the sector has seen funding exceed $1 billion for two consecutive months.

- Key fundraises contributing to the findings were a $225 million investment into Monad backed by Paradigm and Coinbase Ventures, and a $47 million investment led by BlackRock into Securitize.

- The crypto space’s surge in VC funding during the first quarter of 2024 has broken a two-year downtrend.

UK Tax

Think Tank Suggests Post-Election Tax Rises May Be On The Cards

- The National Institute for Economic and Social Research (Niesr) has stated that the next Government will be forced to introduce post-election tax rises and delay net zero investment unless it’s prepared to ‘rip up Treasury rules for managing the state finances.’

- In the think tank’s quarterly health check, they found that the economy had emerged from recession, but stated the “not-fit-for-purpose” fiscal rules left no scope for Chancellor Jeremy Hunt to offer fresh tax cuts before the election.

- Professor Stephen Millard, Niesr’s Deputy Director for Macroeconomics, Modelling and Forecasting said: “Despite the welcome fall in inflation, UK growth remains anaemic. This will make it difficult for any incoming Government to carry out the much-needed investment in infrastructure and the green transition, as well as increase spending on public services and defence, without either raising taxes or rewriting the fiscal rules. This makes clear the need to reform the fiscal framework to enable the Government to do what is needed for the economy in a fiscally sustainable way.”

- Currently, the fiscal rules state that the debt-to-GDP ratio should be falling within five years and the annual deficit-to-GDP ratio should be below 3% by the end of the same period.

- According to Niesr, the Government’s spending plans do not meet the fiscal rules and any future tax cuts or increases in public investment would require a revision of the rules.

Property

Property Market Rebound Hit By Higher Mortgage Rates

- Following three consecutive months of increases, new home buyer enquiries dipped in April according to a survey by The Royal Institution of Chartered Surveyors (RICS).

- The most notable loss of momentum has been seen in London and southern parts of England.

- The survey found a net balance of 1% of property professionals reported new buyer inquiries falling rather than rising in April, following a balance of 6% reporting inquiries rising in March.

- A balance of 5% of professionals also reported prices falling rather than rising in April, as buyers become cautious amidst surging mortgage rates.

- Simon Rubinsohn, Chief Economist at RICS, said: “Feedback to the latest survey demonstrates the sensitivity of the sales market to interest rates at the present time, given the continuing challenge around affordability. A modest back up in mortgage pricing has contributed to the flatlining in the buyer inquiries metric over the past month, as well as the slightly more cautious signals around near-term expectations. That said, there is still a strong perception that activity in the market will pick up in the latter part of the year and into 2025, irrespective of any political uncertainty around the general election.”

Final Note

As the BoE maintains interest rates for the sixth time, it was interesting to hear from the Bank’s Governor that they may need to be cut even faster than is being predicted by the markets. The suggestion of imminent cuts will also likely be a welcome one after the RICS survey’s news of decreasing home buyer enquiries in response to rising mortgage rates.

Furthermore, Niesr’s findings regarding the potential need for post-election tax rises in lieu of an overhaul to the fiscal rules once again exemplifies the need for investor’s to have a well thought out tax-efficient strategy.

At GCV, we remain committed to providing the latest insights into the investment and wider economic landscape in order to support investors in making well-informed decisions when choosing where to allocate their capital.

If you would like to find out more about a number of tax-efficient investment strategies available to UK investors, discover our range of downloadable resources here.

%20(3)%20(2).jpg)