Weekly Briefing: UK Business Confidence Rises, Property Market Trends Positively & Asia's Growth Outlook Improves

In this week's briefing, the UK economy shows positive momentum with rising business confidence and a resilient property market.

Meanwhile, beyond our borders, Asia’s growth outlook improves for 2024 despite short-term and long-term challenges and information following the US Fed’s meeting on Wednesday.

UK Economy

UK business confidence rising and positive economic trends

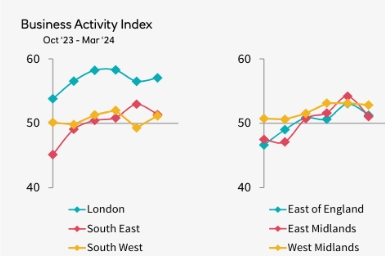

- Data from the latest NatWest UK Regional PMI® indicates that business activity surged in 11 of the 12 UK regions in March. Fuelled by increased demand and decreasing input price inflation, businesses were optimistic about the year ahead.

- Employment trends remained mixed, with job growth apparent in over half of the surveyed areas, albeit amid ongoing cost pressures.

Source: © 2024 S&P Global

Source: © 2024 S&P Global

A reading above 50 signals growth, and the further above the 50 levels the faster the expansion signalled. - Consumer Price Index (CPI) data showed a decrease in inflation to 3.2% in March, primarily due to lower food price inflation.

- The Bank of England (BoE) faces pressure to consider rate cuts, with expectations of a 100 basis points reduction by December, starting in August.

- Imogen Bachra, Head of Non-dollar Rates Strategy, said, “Inflation this month was lower than last month, but still slightly higher than expected. That is likely to prevent the BoE from delivering rate cuts in the near future, but shouldn’t prevent a cut by August when we expect inflation to be below 2% and the labour market to have eased further. Markets currently price in only 40bp of rate cuts this year, which we think looks too low. The BoE is more likely to deliver at least 75 bp of rate cuts, we think.”

UK Property

House prices stand 4% below all-time high, but demand is increasing

- According to the Nationwide Building Society, the average UK house sale price experienced a second consecutive decline in April, now standing 4% below its all-time high.

- In April, UK property sale prices fell by 0.4% month-on-month, following a 0.2% decrease in March, leading to a slowdown in the annual rate of house price growth to 0.6%, down from 1.6% in March.

- Nationwide’s chief economist, Robert Gardner, attributes the slowdown to “ongoing affordability pressures," noting that, “House prices are now around 4% below the all-time highs recorded in the summer of 2022, after taking account of seasonal effects”.

- Recent research by Censuswide, commissioned by Nationwide, suggests that 49% of first-time buyers looking to purchase in the next five years have delayed their plans due to various factors.

- Despite the challenges, there remains positive sentiment among buyers, with increased viewing activity, signalling stability in the housing market.

- Both Purplebricks and Knight Frank anticipate a pick-up in demand and house sale price growth later this year, especially as rate cuts move onto the horizon.

- With increasing demand in the housing market, sale prices are anticipated to gradually align closer to asking prices.

Global Economy

Asia's growth and inflation outlook brightens amid lingering risks

- The IMF economic outlook for Asia and the Pacific has improved for 2024, with their growth forecast at 4.5%, up 0.3 from six months earlier.

- The main countries leading the region's growth are China, India and the Philippines, with India’s GDP projected to grow by nearly 7% in 2024.

- Despite robust growth in demand, inflation in Asia has continued to retreat. This is due to earlier monetary tightening, global price declines, and reduced supply-chain disruptions post-pandemic.

- The IMF has suggested that rising trade restrictions threaten Asia's trade openness and supply chains, particularly impacting Pacific island countries heavily reliant on imports.

- They emphasise the necessity for Asian leaders to invest in capital and digital infrastructure, alongside enhancing workforce skills. This is crucial for maintaining their leadership in global economic growth, especially amidst challenges like ageing populations, declining productivity, and rapid technological advancements.

Federal Reserve Holds Interest Rates Steady Amid Lingering Inflation

- With inflation lingering above the US Federal Reserve target of 2%, the decision to keep rates fixed between 5.25% and 5.5% was made on 30th April.

- By keeping the cost of borrowing high, they hope to cool the economy and reduce the pressures pushing prices up.

- Chair of the Federal Reserve, Jerome Powell, said, “The committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%”.

- Analysts, who previously anticipated the Federal Reserve to initiate rate cuts earlier this year, have been forced to delay their predictions - with some even entertaining the prospect of a rate hike.

- As usual, with many countries closely monitoring the Federal Reserve's actions, it is likely that as the US begins to cut rates, others will follow suit.

- Jerome Powell has cautioned other countries against this, suggesting they may move more swiftly than the US to cut rates due to concerns about a potential economic slowdown.

Final Note

Looking back on the highlights of this week, it's evident that confidence is on the rise among UK businesses. This optimism stems from promising indicators pointing towards a positive trajectory for our economy.

With growing business demand and decreasing inflationary pressures, there's a clear opportunity emerging for investment into UK businesses.

At GCV, we remain committed to providing the latest insights into the investment and wider economic landscape in order to support investors in making well-informed decisions when choosing where to allocate their capital.

If you would like to find out more about a number of tax-efficient investment strategies available to UK investors, discover our range of downloadable resources here.

%20(3)%20(2).jpg)