Weekly Briefing: UK economy tracks to avoid recession, IHT receipts break records & new trading venue to boost startup liquidity

In this week’s briefing, we take a look at a promising new forecast on the outlook for the UK economy from EY Item Club, several tax updates which see IHT receipts soar and the potential for a boosted annual ISA allowance, and more.

UK Economy

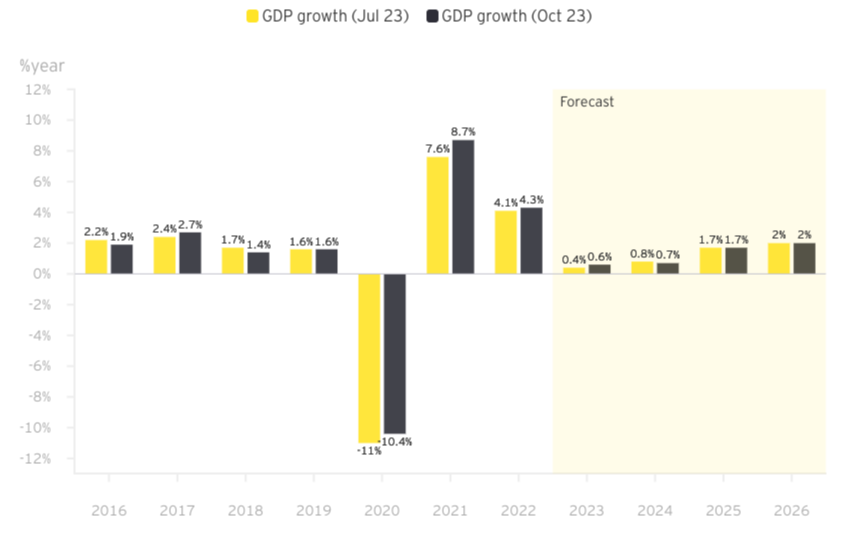

UK economy ‘on course to avoid a recession’, says EY Item Club

- In its Autumn Forecast, the EY Item Club, a leading UK economic forecasting group, has raised its economic output growth forecast to 0.6%, up from its 0.4% forecast issued in July.

- With falling energy and food prices, inflation is on track to fall to around 4.5% by the end of 2023 – faster than a previous forecast of just under 5% – and hit the Bank of England’s (BoE) 2% target by the second half of 2024, according to EY Item Club.

- EY forecast that whilst wage growth will ease, cooling inflation should lift household spending.

- The Office for National Statistics (ONS) recently upgraded historical GDP data to show that the UK economy had expanded by 1.8% since the beginning of the Covid-19 pandemic, faster than Germany and France.

- EY has also suggested that easing price inflation should mean the BoE’s monetary policy committee will hold rates again when they next meet in November, after deciding to maintain interest rates at 5.25% last month following 14 consecutive increases.

- Martin Beck, Chief Economic Adviser to EY Item Club, said: “While recent industry surveys have been fairly gloomy about the UK economy, there have been enough positive developments, including upwards revisions to past data, to lift the mood music and reduce the danger of recession becoming a self-fulfilling prophecy.”

UK GDP forecast

Source: EY Item Club Autumn Forecast 2023.

Source: EY Item Club Autumn Forecast 2023.

UK Tax Update

IHT receipts on course for record-breaking year as they rise again

- HMRC is on track to collect a record-breaking £8 billion in Inheritance Tax (IHT) this year due largely to fiscal drag.

- Between April and August 2023, HMRC received £3.1 billion in IHT, £300 million more than in the same period last year.

- A frozen IHT tax-free threshold, higher property prices and inflation are likely responsible for pushing more households into the IHT net.

- According to MoneyWeek, the value of the average UK home has more than tripled over the past two decades, rising from £84,620 in 2000 to £290,000 today, approaching the £325,000 IHT nil-rate band which has been frozen until at least 2028.

- HMRC figures also show that the IHT receipts for June 2023 were at the highest monthly total on record, attributable to, in part, the impact of interest charged on late payments. This is currently at 7.75%, the highest level for 15 years.

An ISA allowance boost could be on the way for investment into UK companies

- According to a report by the Financial Times, Chancellor Jeremy Hunt looks set to overhaul ISAs in his upcoming Autumn Statement in November, including a possible new, higher tax-free allowance for investments in UK companies.

- The shake-up is reportedly aimed at persuading more people to utilise the tax-free vehicles, as well as encouraging them to use an ISA to back London-listed companies.

- Having met with investment industry executives in recent weeks, UK Treasury officials are also said to be considering changes such as allowing cash savings and stock market investments to be held within a single ISA in an attempt to simplify the product’s offerings.

- The Treasury told MoneyWeek: “HM Treasury is receptive to ideas of how we can make ISAs more attractive to encourage people to develop a savings habit and to invest in a way that works for them.”

Private Markets

Will London's new trading venue boost liquidity for growth startups?

- Pitchbook reports that the London Stock Exchange Group is preparing a new trading venue specifically for shares of private companies.

- In a speech in July, Chancellor Jeremy Hunt confirmed that a new “intermittent trading venue" would be created by the end of 2024, acting as a bridge between the private and public markets.

- The hope is that this will provide new liquidity for growing companies, boost the UK’s capital markets and encourage global companies as well as domestic companies to grow and list in the UK.

- London Exchange officials have now released more information on the new trading venue, including that it will enable the trading of existing shares, meaning it will not be used by companies to issue new capital.

- Darko Hajdukovic, Head of New Primary Markets at the exchange, said: “We have a very good ecosystem of scale-up businesses in the UK. Businesses that have passed their initial growth stage, have a proven business model and now want to grow further. The problem they face is a lack of access to capital or a high cost of capital, or both. One of the reasons is existing investors do not have clear exit strategies. There are limited options available to them to enable liquidity in their shares."

Private Equity

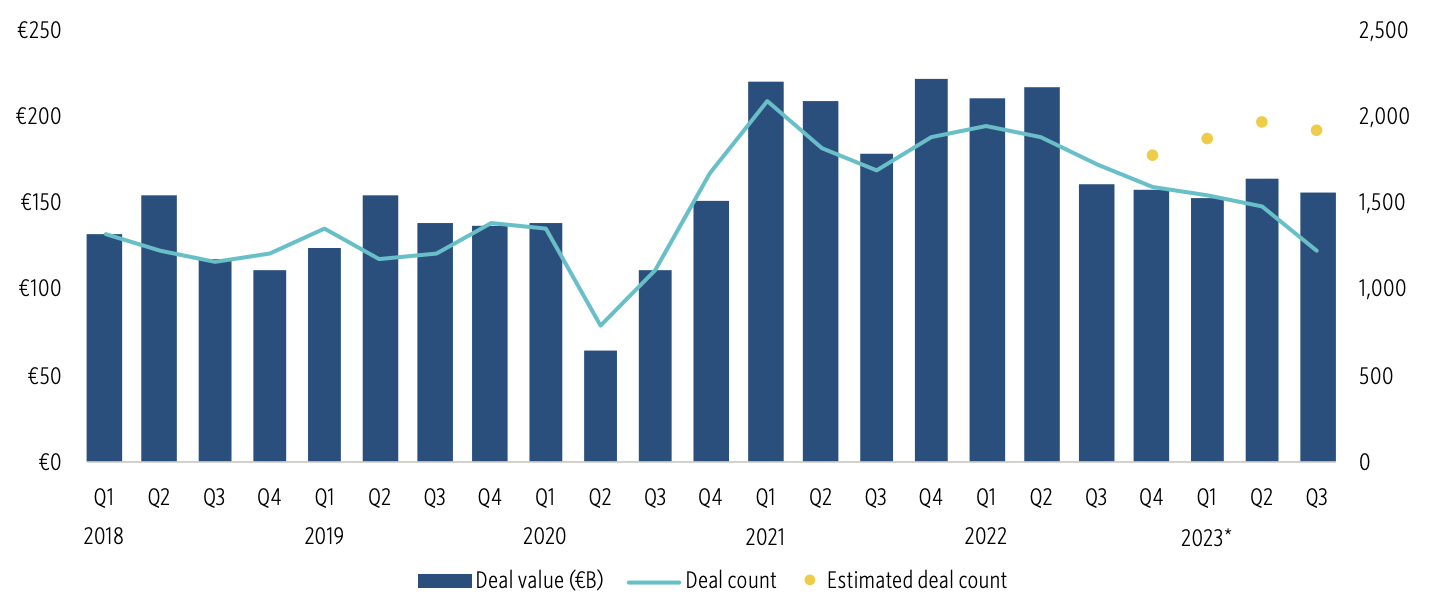

PitchBook’s European PE Breakdown

- In their latest European PE Breakdown, Pitchbook have reported that whilst in Q3 2023 European PE deal value was down 2.8% YoY, it still came in higher than pre-2020 figures.

- There are clear green shoots in the data, such as the average and median deal sizes increasing sequentially in Q3.

- The financial services sector had a record quarter in Q3, with €29.4 billion worth of deals, up 83.8% from Q2 and 244.4% YoY.

- European PE exit value also continued to pick-up for the second consecutive quarter, increasing 18.4% QoQ.

- Regionally, the UK & Ireland accounted for almost a third of deal value in Q3, slightly higher than the 10-year average of 29.7%.

PE deal activity by quarter

*As of Sep. 30, 2023.

*As of Sep. 30, 2023.

Georgraphy: Europe.

Source: PitchBook.

A Final Note

Amidst ongoing challenges, there’s more positive news this week as a UK recession no longer looks set in stone and a potential increase to the ISA allowance could be on the horizon for those looking to back Britain.

However, record breaking IHT receipts do once again highlight the need for investors to explore tax-efficient methods of protecting their assets, in turn enabling them to pass on more wealth to loved ones.

%20(3)%20(2).jpg)