Weekly Briefing: UK FTSE 100 Breaks All-Time High, Housing Market Sees Near-Record Asking Prices & Government Borrowing Exceeds Expectations

In this week’s briefing, the UK economy enters the spotlight as the FTSE 100 hits a new all-time high following a sharp drop in the value of the pound. Meanwhile, the UK property sector has witnessed near all-time high asking prices.

On the other hand, higher-than-expected government spending has reduced the likelihood of further tax cuts pre-election.

Looking globally, a UN report showcases major changes within the foreign investment landscape.

UK Economy

FTSE 100 Soars To New All-Time High As The Pound Drops In Value

- Following the pound's drop in value against the US dollar, this Tuesday morning the UK FTSE 100 soared to 8,076, breaking its previous all-time high of 8,047.

- A rise in the FTSE 100 is often the case when the pound drops and has been seen numerous times, as most of its earnings come from abroad.

Source: londonstockexchange.com

Source: londonstockexchange.com - Since GBP/USD fell to its lowest after 5 months, the FTSE has risen over 8.42%, including a near 1.8% increase since Monday morning. Some top gainers were AB Foods, JD Sports, and Ocado.

- Although the FTSE has made some substantial gains, it still lags behind the German DAX, the United States S&P 500 and the French CAC.

- This can be attributed in part to the UK's focus on nurturing innovative, VC-driven, early-stage companies within the tech industry, which differs from the presence of major tech corporations seen in other markets.UK Housing Market Sees Near-Record Asking Prices Despite Mortgage Rate Volatility.

- While there may be room for improvement, the FTSE's continued growth signals optimism for the future of UK companies on the global stage.

UK Property

UK Housing Market Sees Near-Record Asking Prices Despite Mortgage Rate Volatility

- Average asking prices on homes have risen to a near-record level, coming in at over £372,000 according to Rightmove.

- This increase is mainly driven by larger properties, particularly four-bedroom detached properties, increasing by over 2.7% month-on-month.

- A statement from Tim Bannister, Director of Property Science Innovation at Rightmove, read:

“The top-of-the-ladder sector continues to drive pricing activity at the start of the year, with movers in this sector typically less sensitive to higher mortgage rates, and more equity-rich, contributing to their ability to move.” - Aligning with Tim’s statement, first-time buyer homes saw a near-flat 0.3% rise, leading to an overall 1.7% increase across all property sectors.

- Rightmove has also said the number of properties listed increased 12% year-on-year, with most of these listings being high-end properties.

UK Tax Update

Higher Than Expected Government Borrowing Dampens Prospects for Pre-Election Tax Cuts

- Recent data from the Office of National Statistics (ONS) reveals government borrowing, in the year to March, to be £120.7bn.

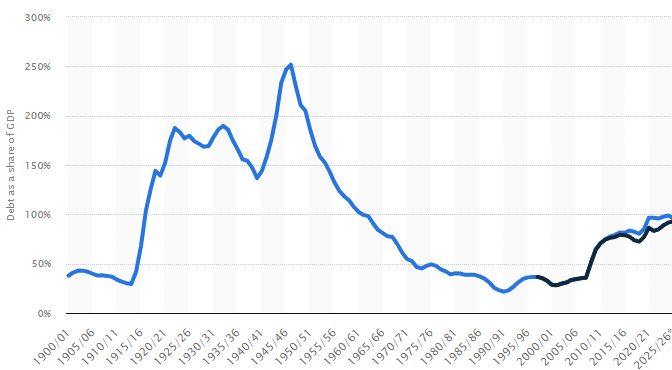

- Using data from Statista 2024, this brings net debt (as a percentage of GDP) to the highest level since 1961/62, currently sitting at 98.8%.

Source: statista.com

Source: statista.com - Since a general election must be held by January 2025, there has been talk of the government cutting taxes again before the end of the year.

- In relation to further tax cuts, Ruth Gregory, Deputy Chief UK Economist at Capital Economics, said: "If the Chancellor was hoping March's figures would provide more scope for tax cuts at a fiscal event later this year, he would have been disappointed."

- She also added that with interest rates no longer forecast to fall so quickly, the government's interest payments could be higher, further tightening their budget.

- Rob Wood, Chief UK Economist at Pantheon Macroeconomics, stated that the to-be-elected government will “face a tricky choice between raising taxes to fix creaking public services or holding the line on the chancellor's recent tax cuts '. He continued: “We suspect whoever the next government is will end up pushing through at least some tax rises to balance the books.”

Global Economy

Report by UN Trade & Development Spotlights Major Shifts In Global Foreign Direct Investment (FDI)

- A report from UN Trade & Development shows Global FDI undergoing significant changes due to shifts in global value chains, the impact of the COVID-19 pandemic, and escalating geopolitical tensions.

- Despite annual GDP and trade growth averaging around 4% and 4.2% respectively since 2010, FDI growth stagnates near zero, reflecting investor caution and exposing vulnerabilities in developing economies.

- The report found that China's role as a top receiver of FDI has changed significantly over the past two decades, “a process that accelerated after the outbreak of the COVID-19 pandemic”.

- Geopolitical tensions have contributed to a decrease in investments between countries with differing political interests, particularly impacting the manufacturing sector amidst escalating trade tensions.

- Investments in environmental technologies like wind and solar energy, alongside electric vehicles and batteries, have witnessed a surge, primarily benefiting developed countries and worsening economic vulnerabilities in developing nations.

Final Note

Reflecting on this week's briefing, the FTSE 100's noteworthy performance coupled with stability in the property market reflects the UK's ability to navigate difficult economic periods. These achievements signal opportunities for growth and innovation, positioning the UK as a competitive player in the global economy.

Furthermore, with the prospect of further tax cuts diminishing and the possibility of tax increases post-election, it reinforces the necessity for investors to consider the most tax-efficient options in this investment landscape.

At GCV, we remain committed to providing the latest insights into the investment and wider economic landscape in order to support investors in making well-informed decisions when choosing where to allocate their capital.

If you would like to find out more about a number of tax-efficient investment strategies available to UK investors, discover our range of downloadable resources here.

%20(3)%20(2).jpg)

.jpg?width=1920&height=1440&name=Shutterstock_1096175375%20(1).jpg)