This week, we discuss the UK’s economic growth prospects, decisions from central banks around the world to further raise interest rates, and three global megatrends that could have significant influence on alternative asset classes and impact investing in the near future.

In addition, we explore why VC firms are prioritising existing investments in Europe, how Blackstone has become the first $1tn private equity manager, and why UK housebuilder share prices are surging.

UK economy

Rising interest rates prompt EY to increase UK growth prospects for 2023

- The UK economy’s resilience so far in 2023 has translated into an upgraded growth forecast for 2023, helping the economy remain on course to avoid a recession.

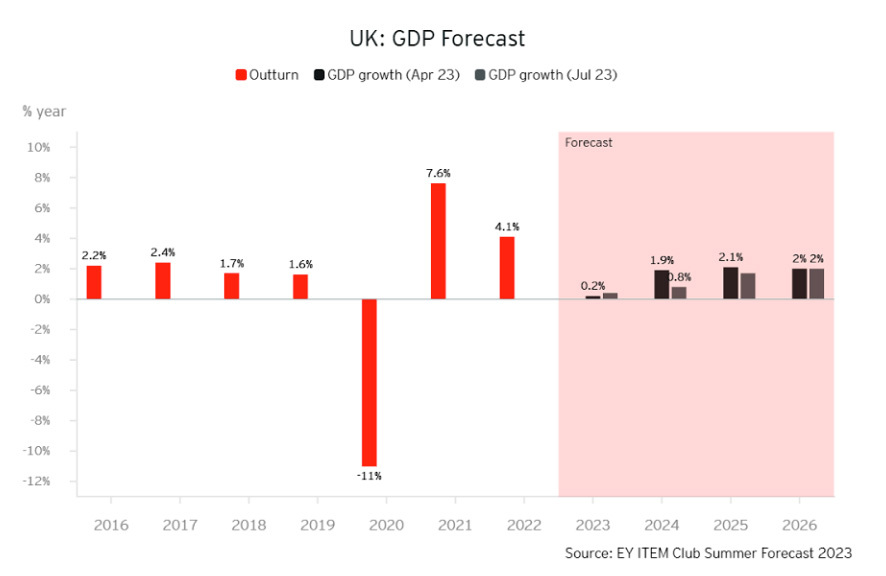

- EY’s ITEM Club expects the economy to grow 0.4% in 2023, up from the 0.2% growth projected earlier in April’s Spring Forecast.

- However, due to rising interest rates – which have a delayed impact on economic growth – the EY ITEM Club has more than halved its forecast for UK economic growth in 2024.

- UK GDP growth rates for 2024 have been reduced from 1.9% predicted in April to 0.8% in the Summer Forecast, reflecting higher-for-longer interest rates and persistent inflation.

- Similarly, EY’s forecast for GDP growth in 2025 has also been downgraded, from 2.3% to 1.7%.

- The EY ITEM Club expects further interest rate rises in August and September 2023 from the Bank of England, with the Bank Rate forecast to peak at 5.5%, before rates start to be cut from the second half of 2024.

- The EY ITEM Club’s model indicates that every 25-basis point increase in Bank Rate reduces GDP growth by 0.1% to 0.2% after around 18 months.

- Inflation is still forecast to fall quickly in the second half of 2023 but is now predicted to end the year at just below 5%, compared to April’s forecast of around 3%.

- Overall, inflation is expected to average 7.6% in 2023 (up from April’s 6.2% forecast), before falling to 3.4% in 2024 (up from 2.5%) and 1.7% in 2025 – the Bank of England isn’t expected to reach its 2% inflation target until late 2024.

Global economy

Federal Reserve increases interest rates to highest level in 22 years

- The US central bank has raised interest rates to the highest level in 22 years as it continues its drive to stabilise prices.

- The decision lifted the Federal Reserve's influential benchmark rate to a range of 5.25% – 5.5%.

- This marks the eleventh increase since early 2022, when the Fed started raising borrowing costs to try and ease inflation.

- Additionally, the ECB raised rates by 25 basis points to a 23-year high, but President Christine Lagarde sent the euro tumbling with indications of a pause in September.

- The euro slid nearly 1% overnight and hit $1.0980 on the morning of Friday 28th July.

UK tax update

What is the UK high earner tax “sinkhole”?

- Jeremy Hunt announced in November that the current freeze on the tax-free personal allowance of £12,570 (which was first imposed in 2021), would be extended to 2028.

- This may have a significant negative impact on UK individuals earning between £100,000 and £125,140, as they risk being brought into a 60% “sinkhole”.

- Individuals can be subject to pay 40% tax on any earnings beyond the £100,000 threshold, as well as another 20% imposed by the gradual tapering of the £12,570 tax-free allowance (£1 is lost from the personal allowance for every £2 an individual earns above £100,000).

- For high earners seeking ways to shield their capital from such traps, there are a number of approaches to consider, including pension contributions (this can ultimately take earnings back down below the £100,000 threshold, whilst simultaneously providing a boost to retirement funds), charitable donations, ISA contributions, and investments into tax efficient schemes such as the Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS), which facilitate investments into early-stage UK startups and, in return, offer investors income tax relief of 30% or 50%, respectively, amongst many other tax advantages.

Impact investing

Global impact investing megatrends: climate change, natural resource scarcity, and social shifts

- Investors hoping to successfully navigate the challenges of the coming years will have to pay close attention to megatrends – which encompass major global themes, from technological progress to shifting geopolitical power dynamics.

- The most transformational considerations include those relating to sustainability: the climate crisis, resource scarcity, and demographic and social changes.

- Climate change: Without decisive action, the world looks likely to miss the Paris Agreement target of limiting temperature increases to well below two degrees Celsius above pre-industrial levels (ideally 1.5 degrees). The physical impacts of climate change – from floods to wildfires and heat waves – are already affecting companies across the world, and are only expected to become more severe.

- Resource scarcity: While the threats of climate change are well understood, less attention has been paid to risks associated with the destruction of nature. As momentum builds, the World Economic Forum (WEF) estimates the transition to a “nature-positive” economy could generate $10tn of business opportunities over the next decade.

- Demographic and social change: In addition to environmental changes, demographics are shifting, with populations ageing in China, Japan, and Western Europe. At a deeper level, social and demographic forces are leading to changes in consumer attitudes. Companies that do not prioritise employee protections - or ones that commit human rights abuses across their supply chains - are encountering new reputational hazards. As these trends play out, companies providing solutions to problems related to social inequality should see opportunities to improve revenues while also contributing to broader economic gains.

- Climate change: Without decisive action, the world looks likely to miss the Paris Agreement target of limiting temperature increases to well below two degrees Celsius above pre-industrial levels (ideally 1.5 degrees). The physical impacts of climate change – from floods to wildfires and heat waves – are already affecting companies across the world, and are only expected to become more severe.

Venture capital

VCs focus on existing European investments

- Follow-on rounds have dominated the European venture deal count as many investors prioritise ensuring the survival of existing portfolio companies.

- Some 70% of rounds in the first half of 2023 were dedicated to follow-on funding, according to PitchBook's Q2 2023 European Venture Report. This figure is about the same level as that of 2022.

- Many VCs this year have been concentrating on restructuring their portfolio companies' operations and extending their runways to withstand the VC winter that is expected to last throughout the year.

- With this increased focus on follow-on funding, deal sizes are trending toward larger numbers.

Private equity

Blackstone becomes first $1tn private equity manager

- Blackstone, a US-based alternative investment management company, becomes the industry’s first $1tn private equity manager.

- At the end of June 2023, the firm’s quarterly earnings report revealed that it managed just over $1tn in assets.

- Passing this milestone puts the firm in the same league as some of the largest mutual funds and banking giants, and for firms like Blackstone, attaining that size cements their position as a major player in mainstream finance.

Property

Housebuilder share prices surge as mortgage rates drop back

- Housebuilders’ share prices have surged after the first concrete evidence emerged of the impact of June’s lower-than-expected inflation figures on borrowing costs for home buyers.

- Financial data provider Moneyfacts stated the average cost of two- and five-year fixed rate mortgages fell overnight since the most recent inflation data was announced. This marks the first drop in both metrics since rates started rising again in late May on renewed inflation fears.

- The average cost of a two-year fixed-rate deal fell back to 6.79%, from 6.81% the previous day, with the average cost of a five-year deal dropping from 6.33% to 6.31%.

- The value of listed housebuilders rose sharply again on the Stock Exchange as news of the mortgage rate falls emerged, with the value of Persimmon shares trading 12% above the level seen prior to the inflation announcement last week.

- Shares in Barratt, Taylor Wimpey, and Vistry have all risen by more than 9% since the figure came out.

A final note

Overall, the UK economy is still displaying clear signs of resilience. As GDP growth forecasts are revised upwards (albeit only to 0.4% for 2023), this signals that inflation is increasingly becoming less of an imminent threat as monetary policy tightening decisions appear to be taking effect. Importantly, the VC, PE, and property investment market each seem to be holding well during the economic turbulence, particularly as global banking pressures begin to settle and house prices start to become more stable.