How to claim EIS tax reliefs: A Comprehensive Guide

At the core of the Enterprise Investment Scheme (EIS) lies a suite of tax incentives crafted to stimulate venture capital investment in promising yet higher-risk enterprises.

By offering a variety of reliefs, the scheme mitigates the inherent risks of investing in early-stage companies, thereby making it more appealing for investors to support innovative ideas and emerging businesses. These tax reliefs not only help reduce current liabilities but also serve as strategic tools for long-term estate and capital planning.

After reading this blog, you should gain a comprehensive understanding of how to claim EIS tax reliefs, including:

- Income Tax Relief

- Capital Gains Tax Deferral Relief

- Capital Gains Tax Exemption Relief

- Inheritance Tax Relief

- Capital Loss Relief

How to claim EIS income tax relief

The way that income tax relief is claimed will vary depending on individual circumstances, including which year the relief is being claimed from and how you wish to claim your relief.

However, to claim any relief, you must first be issued an EIS3 form by the company issuing the shares (which they will obtain from HMRC and complete the details of the investment on the first page). HMRC may request to see your EIS3 certificate for any claims made.

For investors who normally submit a self-assessment tax return, tax relief is claimed by including the details as part of the tax return submitted to HMRC at the end of the year. As a result, there is no need to complete pages 3 and 4 of the certificate.

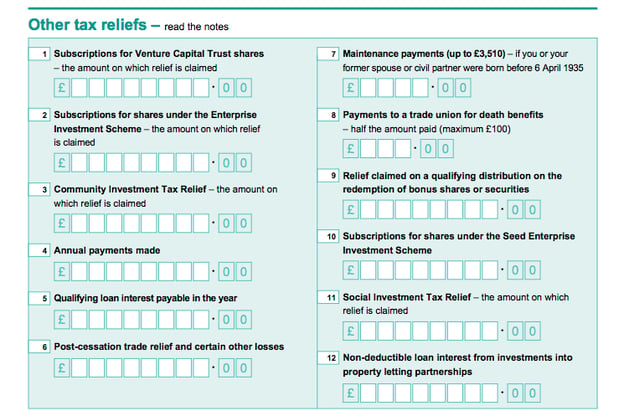

- In the “Other tax reliefs” section of the Additional Information form on page 2, the amount that has been subscribed for under EIS is entered in box 2.

- Please note, that the amount entered is the amount subscribed, not the amount of relief, which will be calculated for you unless specified below. The maximum is £2 million (providing atleast 1million is invest knowledge-intensive companies).

- If you have already received some relief during the year by a change in PAYE code or reduction in payment on account, include this amount. However, if an amount is being claimed from the previous year, the amount is excluded.

- Additional details for each investment should then be provided in the “any other information” box - box 21 - on page 4 of the Additional Information form, or box 19 on page 7 of the tax return, and should include:

- The name of the company invested into

- The amount on which you are claiming relief for this year

- The date of issue of the shares

- The name of the HMRC office issuing the certificate and their reference

- How you wish relief to be attributed due to investing over £1m

- All investments should be listed, where some relief is claimed, even if the total amount is not being claimed

If you wish to use the EIS carry-back facility on shares that have already been issued this current tax year, and you have an EIS3 form, you can include this on your tax return for the previous year and state that this is carried back in the additional details. Likewise, an amended tax return can be filed for the previous tax year, with the carried-back amount included, provided you are within the time allowed for amendments.

If you have been issued an EIS3 certificate for shares issued in the previous tax year and have already filed a tax return, you can complete the form on page 3 of the certificate ticking “Tax Relief for a previous year”, tear off this page and send it to HMRC, who will process this claim, and which may result in an EIS tax rebate.

If you are paid through PAYE or do not normally complete a tax return, you are able to claim tax relief through an adjustment of your PAYE tax code for the year. To do this, you need to complete the third and fourth pages of the EIS3 certificate, tick “Tax Relief in PAYE coding”, and return this to your HMRC tax office, which will amend your tax code for the year. You will then need to make the claim on your tax return if it is received from HMRC at the end of the tax year. It's important to note that EIS income tax relief can only be carried back by one year, and can't be passed forward into future tax years.

Claiming Inheritance Tax Relief

Most people don't think about inheritance tax, and it's understandable why they don’t want to. However, for those who need to pay it, it is expensive and can feel excessive. Therefore, if people know it will be coming, they can dedicate significant time to mitigating IHT through whatever means are available.

With some options particularly in-depth, EIS investments offer an easy, government-supported way to plan for this eventuality, but firstly it's important to be clear on what Inheritance tax is.

Payable on a person's estate after they die, an estate consists of their overall wealth and possessions including their property, assets, vehicles, belongings and any other wealth they may have accumulated over the years. Shares are included in this estate at a fair value rate, meaning they are valued at the point the holder dies, not using the amount invested.

For the current tax year, the IHT rate is 40%, paid on everything over £325,000 - the personal estate tax-free threshold. As an example, if your estate is worth £500,000 you would pay £70,000 in IHT (£500k minus £325k is £175k, taxed at a rate of 40%), leaving an estate of £430,000.

However, if shares held as part of the estate are EIS shares, they qualify for Business Property Relief (BPR) as an interest in a business or unlisted shares and get 100% IHT relief. This means that these shares, at fair value, are excluded from the holder’s estate and can be passed on without paying any tax on the shares without reducing the personal estate tax-free threshold.

As an example, if £100,000 of the above estate is invested into EIS shares, and has become worth £160,000 in fair value at the point the holder dies, you would save the £64,000 in IHT (£160,000 taxed @ 40%) that is owed on the shares. However, there is no clawback on the income tax relief, so the savings can be considered to be even higher when the £30,000 income tax is included in the estate:

|

|

Without EIS investment |

EIS investment |

|

Estate Value at point of investment |

£500,000 |

£400,000 |

|

EIS investment |

£0 |

£100,000 |

|

Income tax relief |

£0 |

(£30,000) |

|

Estate value after investment |

£500,000 |

£530,000 |

|

Fair value of EIS shares for IHT |

£0 |

£160,000 |

|

Value of estate for IHT |

£500,000 |

£590,000 |

|

Expected IHT on Estate |

£70,000 |

£106,000 |

|

IHT Relief |

£0 |

(£64,000) |

|

IHT Paid |

£70,000 |

£42,000 |

|

Value of estate passed on |

£430,000 |

£548,000 |

If you need a hand visualising this for your financial situation, you could combine the use of our EIS calculator and inheritance tax calculator, to build a better picture of how the EIS scheme can help preserve more of your wealth for future generations.

How to Claim EIS Tax Reliefs: Capital Gains Tax

Beyond income tax relief, EIS offers two key capital gains tax incentives: CGT deferral relief and CGT disposal relief. Deferral relief lets you postpone paying tax on gains from the sale of other assets—as long as those gains are reinvested into EIS-eligible shares—effectively allowing you to shift tax liabilities to a later date and better manage your annual allowances. Notably, this deferral applies even beyond the income tax relief limit, meaning any reinvested amount qualifies.

Complementing this is the CGT disposal relief. When you eventually sell your EIS shares at a gain, this relief exempts the gain from capital gains taxation (the current capital gains tax rate for high-earners is 24%), regardless of the usual rates that might apply. This exemption not only preserves your annual allowance but can also be used to settle any deferred tax liabilities, making it a powerful tool for maximising returns compared to traditional equity investments.

For a clear picture of your potential tax benefits, consider using an EIS calculator alongside a capital gains tax calculator.

Claiming Capital Gains Tax Disposal Relief

To claim CGT disposal relief, you must have held the qualifying shares for a minimum of 3 years from when the shares were issued, or 3 years from when the company began trading, if later. This 3-year holding period is the same as that required for you to receive income tax relief in full, so is usually quoted as the general holding period for EIS-eligible shares.

More interestingly you must also have claimed income tax relief in full on your subscription, with none of the income tax relief withdrawn. This condition is relaxed somewhat in the case that you are unable to claim the full relief - if you have invested sufficient to reduce your income tax liability to zero, for example. In this case, you need to have claimed some income tax relief and not had any of this amount withdrawn. However, if you have invested more than the maximum subscription in a year, only part of the gain may be capital gains exempt.

This relief is offered automatically, as long as the qualifying conditions are met. Therefore the gain is treated as an exempt gain, so does not need to be included in your disposal proceeds. However, details of the disposal should be included in the 'Any other information' box of your Capital Gains summary form, as part of your annual tax return, so to make it clear that EIS shares were disposed of, which are exempt.

How to Claim CGT Deferral Relief

As with income tax relief, to claim capital gains deferral you need to wait until you receive the EIS3 form from the issuing company before you can claim any relief. You do not need to have received income tax relief on the EIS shares - this can be claimed independently of any other reliefs.

To claim EIS deferral relief you must complete the claim form attached to the EIS3 certificate. This form is then attached to the capital gains summary pages of your tax return, and if the gain against which you are claiming deferral relief arose in the tax year to which this return relates, details of the claim should be provided in the ‘Any other information’ box, or in your computation, providing a clear statement that you are claiming EIS deferral relief. You must still include these chargeable gains in the capital gains summary pages when completing your tax return.

Investors can file this claim up to five years from the 31st of January after the date EIS shares were issued.

How To Claim Loss Relief

You can claim EIS loss relief without having previously claimed income tax relief—if you offset the loss against income, you automatically qualify for income tax relief (provided no relief has been withdrawn). Qualifying capital losses may be set against income in the disposal year or the preceding tax year (to benefit from a higher marginal rate) using the SA108 form under “Unlisted shares and securities.” Losses can also offset capital gains, with any excess carried forward.

If your EIS shares become negligible in value, you may claim a negligible value relief by reporting the effective loss (using the appropriate section on your CGT summary). Overall, loss relief is capped at £50,000 or 25% of your adjusted total income, and you have up to four years from the disposal to claim it. Always retain your EIS3 certificate, as HMRC may require the original for evidence.

Beyond the £50,000 limit, you can claim a capital loss and carry it forward to offset future capital gains. There's no time limit on how long you can use this loss, and you can continue to apply it against your capital gains in future years until the loss is fully utilised. You can claim this loss relief as many times as needed, reducing your CGT liability each year you have gains to offset. Just remember to report the carried-forward loss on your annual tax return.

How To Claim Your EIS Tax Reliefs in Practice

While each of the tax reliefs offered under the EIS has its own specific requirements and nuances, the overall process generally hinges on receiving your EIS3 certificate. This certificate is the linchpin for all claims—it is issued by the company once it has been trading for the requisite period (usually at least four months) and contains all the necessary details to support your claim across the various reliefs.

For income tax relief, once you have your certificate, you can either include the claim in your self-assessment tax return or, if you are on PAYE, submit the appropriate pages to your HMRC office to adjust your tax code. For CGT deferral relief, you must attach the claim form that comes with your EIS3 certificate to the relevant pages of your tax return, ensuring that you also include details of the gain you wish to defer. When it comes to CGT disposal relief, the exemption is applied automatically once the qualifying conditions are met, but you should still document the disposal in your tax return for clarity.

A practical point to bear in mind is that each of these claims has time limits. For income tax relief and CGT deferral relief, claims must be made within five years of the 31st January following the tax year of share issuance. Failing to meet these deadlines could result in the loss of a valuable tax benefit. Similarly, the holding periods—two years for IHT relief and three years for full income tax and CGT disposal relief—are fixed requirements that must be observed.

There are even provisions for special circumstances, such as a negligible value EIS claim. This situation arises when an investor’s EIS shares have become nearly worthless. While the process for such claims may differ, it is an important area to discuss with your tax advisor to ensure that all possible avenues for tax relief are explored.

Final Thoughts

The Enterprise Investment Scheme remains one of the most effective ways for investors to support innovative UK businesses while simultaneously reducing their own tax liabilities. Whether through the immediate benefit of 30% income tax relief, the estate planning advantages of IHT relief, or the strategic management of capital gains via deferral and exemption, the EIS offers a multi-faceted approach to tax efficiency.

By understanding the nuances of each relief and adhering to the specific claim processes and time limits, investors can maximise the benefits available under the scheme. It is advisable to keep meticulous records—especially your EIS3 certificates—and to consult with a professional advisor to navigate the sometimes complex landscape of tax relief claims.

Invest wisely, ensure you meet the holding periods, and take advantage of the generous tax reliefs the EIS offers. With careful planning and timely claims, you can significantly enhance your investment returns while also contributing to the growth of the next generation of British businesses.

Hopefully, after reading this blog, you can better understand how to claim EIS tax reliefs. If you still have questions or require guidance on specific situations, such as a negligible value EIS claim or detailed timelines for claiming income tax relief, it’s best to reach out to HMRC, an accountant, or a tax advisor for these more personal situations.

Investing in EIS-eligible opportunities

Investing under the Enterprise Investment Scheme framework offers the chance to back transformative British businesses, build a diversified portfolio of high-growth startups, and benefit from substantial tax reliefs. Although undoubtedly one of the best tax-efficient investments available to UK investors, it's important to remember that startup investments carry higher risks.

At GCV, we present a select range of meticulously curated EIS opportunities each year—designed to deliver exceptional returns, up to 75x for our investors, along with significant tax benefits. Our dedicated investment team evaluates over 750 opportunities annually to ensure we bring only the best prospects to our network.

Through GCV Labs, our venture builder team collaborates closely with our portfolio companies to enhance their growth and scalability, providing deeper insights and robust support in areas such as app development and marketing strategies.

Join GCV Invest, our exclusive network for experienced investors, and gain access to EIS-eligible opportunities targeting average returns of 10x. Discover how these investments can work for you by using our EIS calculator to explore the potential financial advantages and tax reliefs available.

It is equally important to identify the risks associated with these tax reliefs. By joining GCV Invest, you can ensure.

How to claim EIS tax Releifs FAQ

1. How do I know when I’m eligible to claim an EIS tax relief?

The eligibility for claiming EIS tax reliefs hinges on meeting the conditions set out by HMRC and your investment provider. Before you can submit your claim, you must have received the official certificate (EIS3), which confirms that the investment qualifies for the relevant relief. If you’ve met the holding period and other qualifying criteria, you are in a position to claim the relief.

2. What are the deadlines for claiming EIS tax reliefs?

All claims must be submitted within a specific time frame: you need to file your claim within five years of the 31st January following the tax year in which your shares were issued. This deadline applies uniformly across the various reliefs, so it’s crucial to mark your calendar and plan your paperwork accordingly.

3. Can I claim tax relief for shares issued in a previous tax year?

Yes, you can claim relief for shares that were issued in an earlier tax year as long as you remain within the prescribed claim window. If you receive your EIS3 certificate after the end of the tax year, there is still an opportunity to submit a claim by amending your previous tax return or carrying the claim back, depending on your circumstances.

4. What should I do if I haven’t received my EIS3 certificate yet?

You must wait until the company issues your EIS3 certificate before you can submit your claim. This certificate is typically issued after the company has been trading for the required period. If you experience an unusual delay, it’s a good idea to contact the investment provider directly for an update, as the certificate is indispensable for filing your claim. With GCV Invest, as a broad guideline, your EIS3 form should be with you within 6 to 8 weeks of the investment round being closed.

5. How do I submit my claim if I file a self-assessment tax return versus using PAYE?

If you complete a self-assessment tax return, you will include your claim details in the designated section for additional tax relief. On the other hand, if you’re paid through PAYE and don’t file a self-assessment return, you must forward the relevant pages of your EIS3 certificate to your local HMRC office so they can adjust your tax code accordingly. The method of submission will depend on your typical tax filing process.

6. I invested more than the annual maximum limit—how does this affect my claim?

The reliefs have annual limits, and if you invest beyond these thresholds, only the eligible portion of your investment will qualify for tax relief. It is important to review your investment amounts in relation to the annual limits set by HMRC, as any excess may not attract the relief, potentially affecting the overall tax benefit you receive.

7. How do I handle a negligible value claim for my EIS shares?

In cases where your EIS shares have depreciated to a negligible value, there is a specific claim process available to potentially adjust the relief claimed. Since this situation involves additional complexity, it is advisable to consult your tax advisor to ensure that the claim is submitted correctly and that you are taking advantage of any available adjustments.

8. What steps should I take if I lose my EIS3 certificate?

Because the EIS3 certificate is crucial for substantiating your claim, it is important to have a secure record of it. If you misplace or lose the certificate, contact the company or HMRC as soon as possible to request a replacement. Bear in mind that obtaining a new certificate can take some time, so it is best to resolve this issue before attempting to submit your claim.

%20(3)%20(2).jpg)