Open fast find

Close fast find

Inheritance tax planning: incorporating tax efficient investments

Inheritance tax (IHT) can be a significant financial burden on families, often requiring inherited assets to be sold or restructured in order to cover the tax bill.

However, with careful planning and the incorporation of tax-efficient investments, it is possible to reduce or even fully eliminate an IHT liability.

Below, we discuss some of the current inheritance tax rules in the UK, as well as three investment schemes that could help mitigate the impact of IHT on a growing number of UK families.

What are the current inheritance tax rules in the UK?

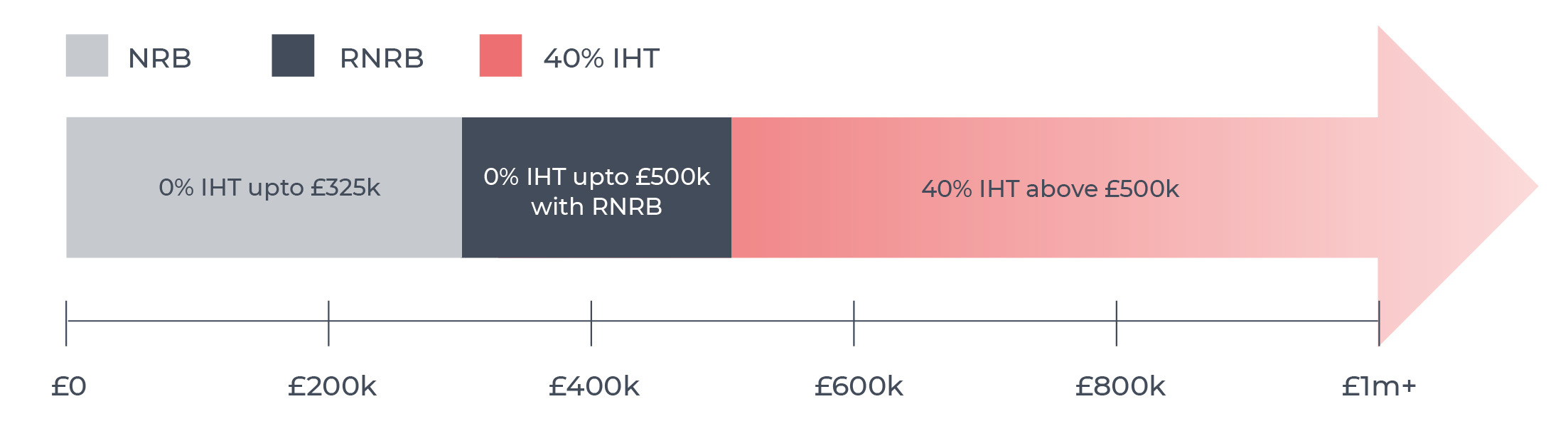

In the UK, inheritance tax may be levied on the value of an individual’s estate (the total sum of all of their assets) when they pass away. The current IHT threshold (also known as the nil-rate band [NRB]) is £325,000, meaning that any estates below this figure are not subject to any IHT, whilst anything above this amount is taxed at a rate of 40%.

However, there are some additional exemptions and reliefs available, such as the residence nil-rate band (RNRB) – which allows individuals to pass on an additional £175,000 tax-free if they leave their main residence to direct descendants.

Despite these exemptions, many families still find themselves facing a substantial IHT bill. This is where tax-efficient investments can offer significant benefits.

Working out your potential IHT bill by using an inheritance tax calculator is a useful task to start your tax planning journey.

What are inheritance tax-efficient investments?

Inheritance tax-efficient investments include opportunities that offer tax benefits specifically aimed at mitigating the impact of IHT. These investments provide individuals with the ability to reduce or eliminate their IHT liability, as well as the potential to earn competitive returns on their invested capital.

Three notable examples of such investments are the Enterprise Investment Scheme (EIS), the Seed Enterprise Investment Scheme (SEIS), and AIM ISAs.

Ultimately, these inheritance tax-efficient investments present opportunities to reduce your IHT liability whilst supporting innovative startups and scaleups and targeting superior returns. It is crucial to understand the eligibility criteria, risks, and benefits associated with each scheme, and to seek professional financial advice tailored to individual circumstances.

By utilising these investment options, individuals can take strategic steps to minimise their IHT liability and maximise the benefits of their investments.

Incorporating the EIS into inheritance tax planning

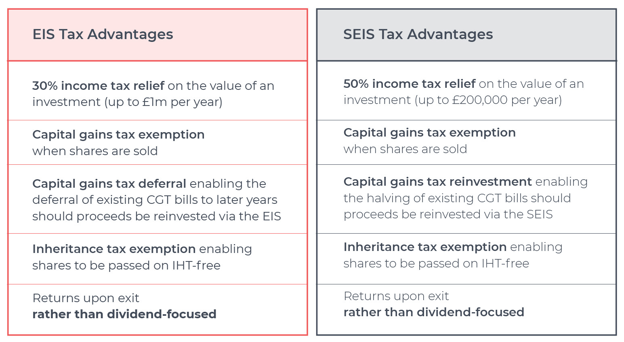

The Enterprise Investment Scheme (EIS) is a government-backed initiative that encourages investment in small and medium-sized companies. In return, the scheme offers investors a range of generous tax reliefs, including EIS shares being completely exempt from inheritance tax provided they have been held for at least two years.

This means that UK taxpayers can invest up to £1 million per tax year in EIS shares, the full value of which can be passed on to beneficiaries free of inheritance tax following the investor’s passing. For high-net-worth individuals (HNWIs) or those with substantial estates, the EIS can be a particularly attractive option for passing on large sums of wealth to beneficiaries, IHT-free.

In addition, investments made into EIS-eligible companies can enable investors to claim up to 30% income tax relief, capital gains tax (CGT) disposal relief, CGT deferral relief and EIS loss relief.

To qualify for EIS tax reliefs, investors must invest in shares of qualifying companies that meet certain criteria, such as having fewer than 250 employees and less than £15 million in assets (to ensure significant growth potential).

Overall, the scheme can be a favoured option for experienced investors and individuals with considerable estates who are comfortable with taking on higher-risk higher-return strategies and are looking to minimise an IHT liability.

Incorporating the SEIS into inheritance tax planning

The Seed Enterprise Investment Scheme (SEIS) is similar to the EIS but is targeted at smaller companies in relatively earlier stages of growth.

The SEIS offers a comparatively more generous range of tax reliefs than the EIS (to offset the added risk of investing in especially early-stage companies), including up to 50% income tax relief, CGT disposal relief, CGT reinvestment relief and loss relief. Notably, investments made via the SEIS can also be exempt from IHT, provided they have been held for at least two years.

To qualify for SEIS tax reliefs, investors must invest in shares of qualifying companies that meet certain criteria, such as having fewer than 25 employees and less than £350,000 in assets.

Overall, the scheme may be most attractive to investors who are willing to take on a higher level of risk in exchange for potentially greater returns and tax benefits.

Incorporating AIM ISAs into Inheritance Tax Planning

An AIM ISA is an investment vehicle that enables individuals to invest in companies listed on the Alternative Investment Market (AIM) – a sub-market of the London Stock Exchange – and access the income tax, dividends tax and capital gains tax benefits associated with ISAs, as well as inheritance tax exemption.

This IHT exemption can be a particular draw to AIM ISAs, as it is a tax benefit not shared by the rest of the ISA family.

Investing in an AIM ISA can be a favoured option for individuals who are looking for a range of tax reliefs but prefer to invest in later-stage, larger companies that are listed on a junior stock exchange. However, it is worth noting that AIM ISAs do not offer as generous tax reliefs as those offered by the EIS and SEIS.

Other routes to consider when inheritance tax planning

In addition to tax-efficient investments, there are several other considerations that individuals can take note of to mitigate their IHT liability. These include:

- Gifting money to friends and/or family members: One way to reduce the value of your estate is to gift money to your loved ones. You can give up to £3,000 per year IHT-free, and any unused allowance can be carried forward for one year. You can also make small gifts of up to £250 per person per year, as well as tax-exempt gifts for weddings or civil partnerships.

- Making charitable donations: Charitable donations can be deducted from the value of your estate for IHT purposes. If you leave at least 10% of your total estate to charity, the IHT rate on the remaining estate will be reduced from 40% to 36%.

- Establishing a trust: A trust is a legal arrangement that allows you to transfer assets out of your estate and thus reduce the value of your estate for IHT purposes. There are many different types of trusts, each with its own tax implications, so it is important to seek professional advice before establishing a trust.

- Leaving your estate to your spouse or civil partner: Any assets that you leave to your spouse or civil partner are exempt from IHT, regardless of their value. This means that, even if your estate is above the current £325,000 IHT threshold, you can leave everything to your spouse or civil partner without any tax implications. However, when they pass away, their estate could attract an IHT liability in the future.

- Contributing to your pension: Any capital that you contribute to your pension is also outside of your estate for IHT purposes. This means that if you are able to contribute to your pension, you could reduce the value of your estate and therefore your IHT liability.

- Fully utilising all tax-free allowances: It is important to make sure that you are fully utilising all available tax-free allowances, including the nil-rate band and the residence nil-rate band. These allowances can be complex, so it is important to seek professional advice to ensure that you are maximising the benefits they offer.

Considering all of your options

In conclusion, there are many different routes that individuals can take to mitigate their IHT liability, with tax-efficient investments being among the most effective.

The EIS and SEIS, in particular, offer a range of tax reliefs that can help to reduce or eliminate an IHT liability, but it is important to remember that these investments carry a higher level of risk than traditional investments.

Furthermore, it is equally important to consider other options such as gifting, making charitable donations, creating a trust, leaving assets to a spouse or civil partner, contributing to a pension, and fully utilising all tax-free allowances.

Ultimately, no two inheritance tax plans will be the same, and the most appropriate route an individual can follow for minimising their IHT liabilities will vary from person to person.

In turn, seeking professional advice tailored to your individual circumstances and conducting thorough personal research into the full range of options available for reducing inheritance tax can help ensure that you take the most appropriate steps to minimise your IHT liability.

%20(3)%20(2).jpg)